News Next article

Third consecutive month of increases for NZ property prices

April Property Price Index

14 May 2024New Zealand’s property prices have recorded a year on year increase for the third consecutive month according to Trade Me's Property Price Index for April.

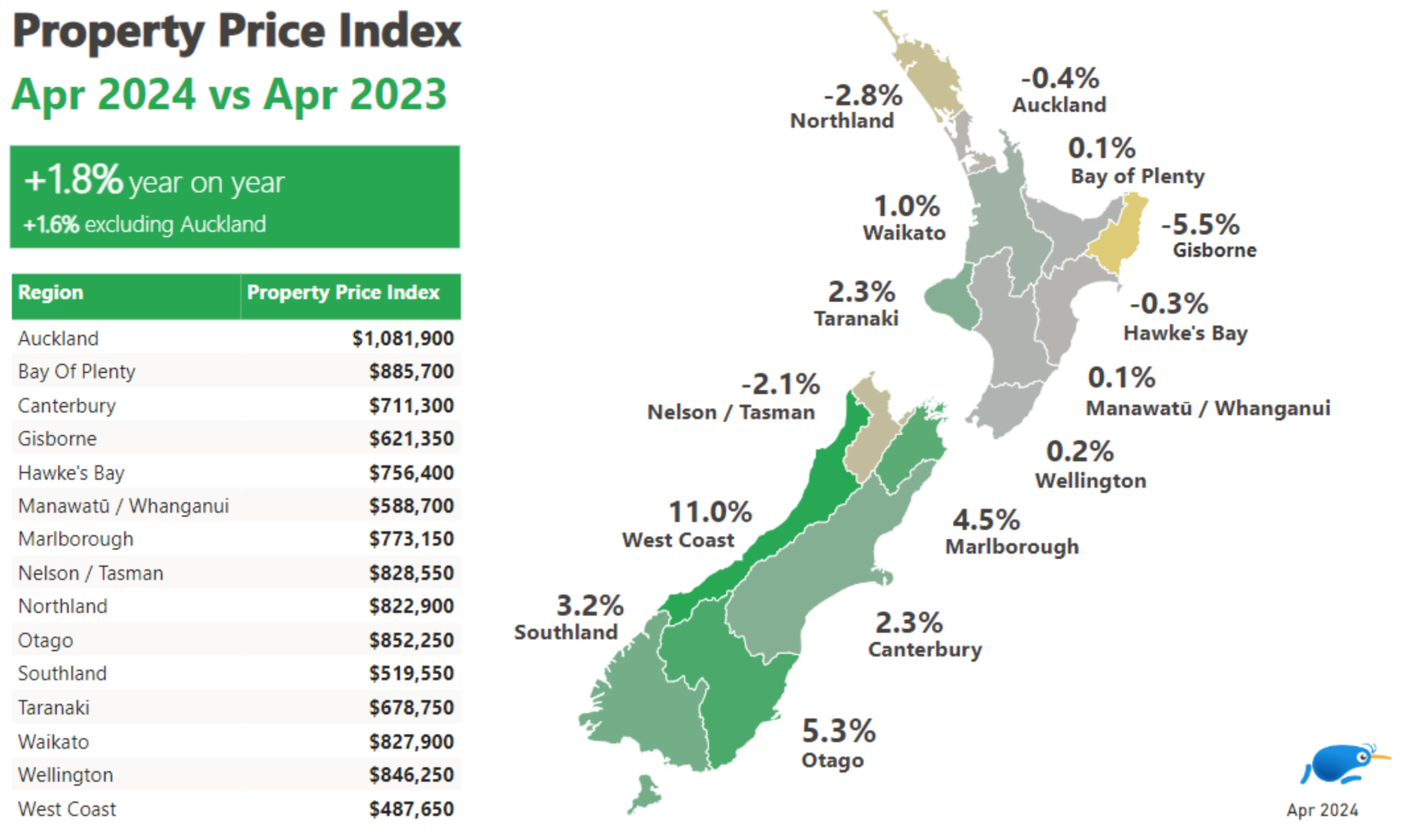

The national average asking price for a property was recorded at $878,100, up 1.8 per cent compared to the same time last year.

"New Zealand's property prices have been going up for three months in a row now when we look at the year on year data. But as autumn sets in, things might ease a bit as we head into winter when buyer activity tends to slow down. We have seen prices come down when we look at the month on month data after the peak of summer.”

“It's important to remain cautious as the majority of these increases have been minor - we will be watching the market to see if this trend will keep going or if it'll start to slow down," said Trade Me Spokesperson Casey Wylde.

West Coast records double digit growth

The increase in the average asking price was led by the South Island, where most regions experienced a hike in prices with the West Coast seeing the biggest increase again, up by 11 per cent to $487,650.

Otago saw the next highest increase up 5.3 per cent to $852,250, followed by Marlborough which recorded an increase of 4.5 per cent to $773,150. Nelson/Tasman was the only region in the South Island which recorded a decline, dipping by 2.1 per cent to $828,550.

When looking at the North Island, Taranaki recorded the biggest increase, however it was still a modest 2.3 percent. The next highest increase was the Waikato region (1%) followed by Wellington (0.2%).

The biggest decline for the North Island was Gisborne which came down by 5.5 percent compared to the previous year.

“We have seen an increase in the Wellington region for the first time in almost two years which was due to Upper Hutt (8.4%), Porirua (2.4%) and Wellington City (0.6%) all seeing a rise in the average asking price,” Wylde said.

“However the Auckland region still continues to drop with the average asking price hovering around the million dollar mark at now $1,081,900. Manukau City had the biggest drop in Auckland, down by about $48,000 (4.7%) compared to the same time last year,” she added.

Wellington City houses see a decline

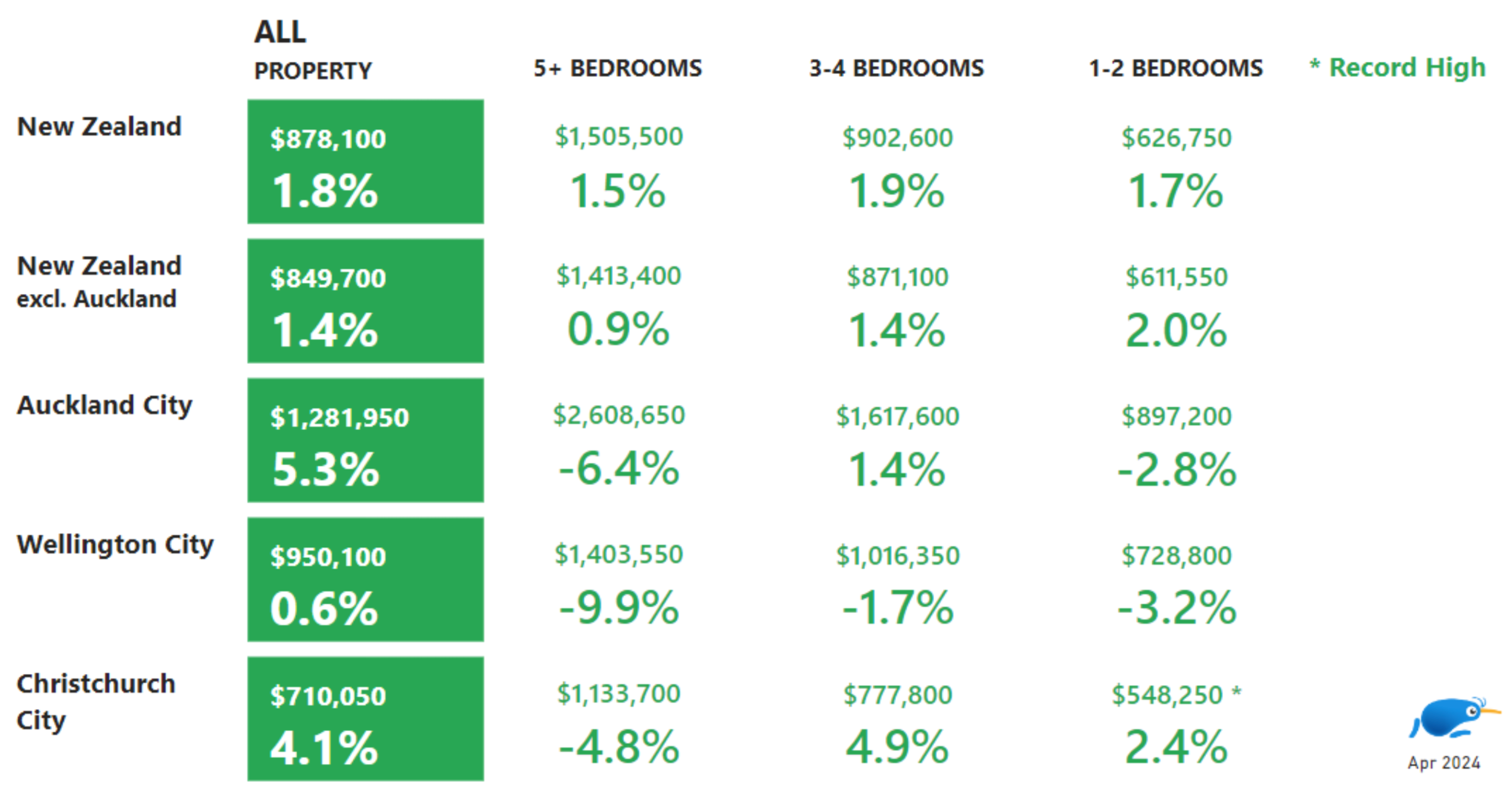

When looking at the major urban cities, Wellington city witnessed a decline across all sized houses.

“When we look at houses, properties that have five bedrooms or more have dropped by 9.9 per cent making the average asking price $1,403,550. Properties with 3-4 bedrooms dropped by 1.7 per cent to $1,016,350 and smaller dwellings with 1-2 bedrooms now sit around $728,800 down by 3.2 per cent year on year,” said Wylde.

“We've also seen a decrease in the maximum search price that people are willing to pay. This peaked in February but has been steadily declining since then. This could be from uncertainty about job security in the capital which is making potential buyers hesitant to enter the housing market. This decreased demand is forcing sellers to adjust their expectations if they want to make a sale in this challenging environment,” she said

The capital's average asking price is now $950,100 (0.6%) for all properties but this overall increase was mainly due to smaller dwellings, with apartments units and townhouses helping boost prices.

In the South Island Christchurch is still seeing the biggest increases in properties with four bedrooms or less. The garden city recorded a record high for properties with 1-2 bedrooms, the average asking price was recorded at $548,250 up 2,4 per cent.

Properties with 3-4 bedrooms also increased, up 4.9 per cent to $777,800 which is almost an extra $40,000 compared to the same time last year. However larger properties with five or more bedrooms have come back down after jumping in April, down 4.8 per cent to $1,133,700.

In Tāmaki Makaurau, buyers will be paying on average around $1,281,950 which is a 5.3 per cent increase year on year, the largest increase of all the cities, said Wylde.

“Despite this overall increase properties with five or more bedrooms dropped 6.4 percent to $2,608,650 and 1-2 bedroom properties dropped by 2.8 per cent to 897,200 - meaning buyers will have to settle for a smaller home if they don’t want to be paying over a million dollars in the city," highlighted Casey Wylde.

Spike in supply and demand

Interest in properties on the market rose year on year, showing a 7 per cent increase in April compared to the same time last year. This demand has spiked in areas such as Gisborne (36%) and Canterbury (12%).

The nation’s housing supply has also gone up by 17 per cent year on year, continuing to help to balance out the demand for properties on the market. Gisborne recorded the biggest jump in the amount of properties available compared to April 2023, up 41 per cent.

“The West Coast is the only region that saw a decrease in listing onsite, down by 6 per cent, however listing views were also down in the region, it had the biggest decrease of 13 per cent, so it's definitely an area to watch as prices continue to rise there.” said Wylde.