News Next article

Property prices see biggest drop in five years

November Property Price Index 2022

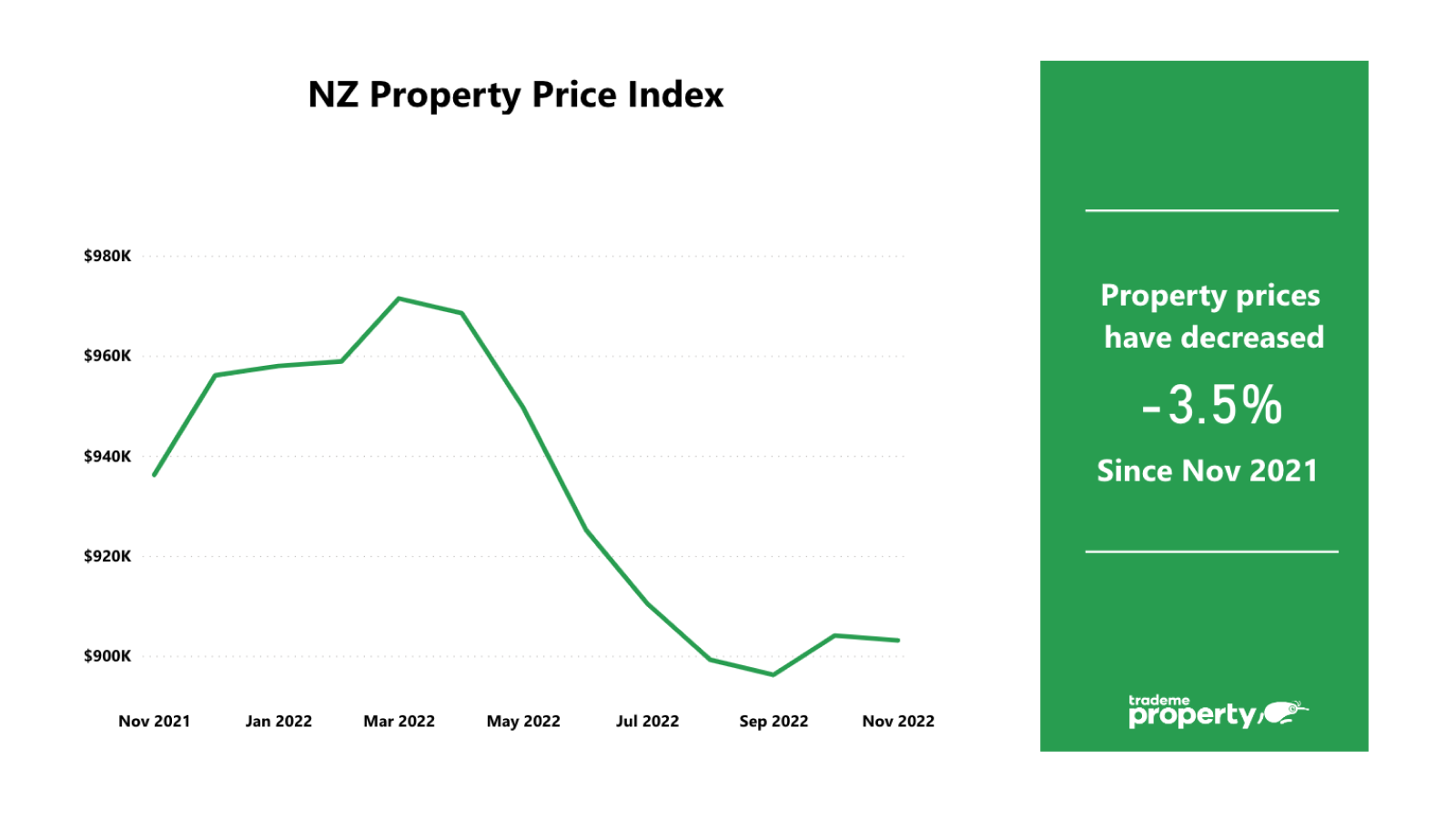

13 December 2022New Zealand property prices fell 4 per cent in November, marking the largest year-on-year drop in five years, according to the latest Trade Me Property Price Index.

Trade Me Property Sales Director Gavin Lloyd said the average asking price for a property in New Zealand was $903,100 last month, down $68,350 from the record high seen in March. “This is the first year-on-year drop we’ve seen since March 2018, when the national average asking price fell by 1 per cent in 12 months, to $636,650.

“While we have seen signs of a changing market over the past six months, November marked a real turning point for property prices. It’s hard to imagine that this time last year we were seeing meteoric price increases right around the country.”

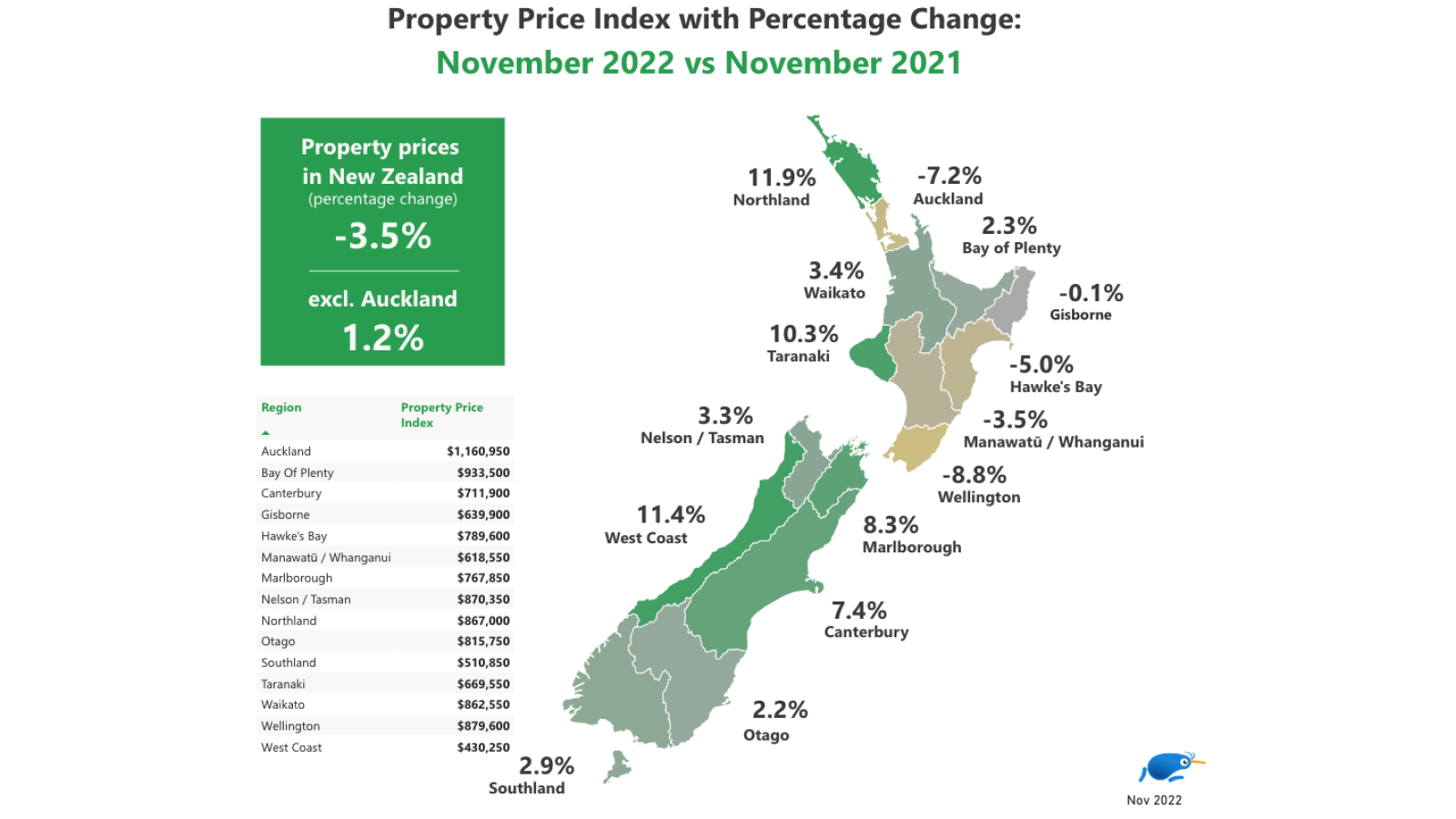

Mr Lloyd said prices fell the furthest in the main centres. “As we saw previously in October, the Wellington region led the charge, with its average asking price dropping by 9 per cent in November when compared with the same month in 2021, falling to $879,600.

“The Auckland region was not far behind, with its average asking price falling by 7 per cent year-on-year in November, to $1,160,950.” Mr Lloyd said the other regions that saw a drop in average asking price were Hawke’s Bay (-5%), and Manawatū/Whanganui (-4%).

However, not every region saw property prices tumble in November. “Northland (+12%), West Coast (11%) and Taranaki (+10%) bucked the trend with their average asking prices jumping by more than 10 per cent year-on-year last month.”

Mr Lloyd said typically market trends start in the main centres, and then the provinces follow suit. “Historically, we’ve seen price increases take off in the regions much later than in the main centres, so we may well see this pattern repeated with price drops.”

Supply at a record-breaking high

Mr Lloyd said there were more properties for sale than in any other month on record in November. “Now is typically when we see the market really take off and despite prices falling, this year is no exception.”

Looking back to the same month in 2021, Mr Lloyd said supply was up by 25 per cent nationwide in November, with every region except Gisborne seeing an increase. “The biggest jumps were seen in the Nelson/Tasman (+77%), Waikato (+56%), Northland (+54%), Bay of Plenty (+54%), and Marlborough (+52%) regions.

“In the main centres, supply increases were smaller but still notable, with the number of properties for sale up 16 per cent year-on-year in the Wellington region and up 11 per cent in the Auckland region.”

On the other hand, Mr Lloyd said demand slowed down nationwide, with every region except Bay of Plenty and Marlborough seeing a year-on-year drop last month.

“These supply and demand changes really show us how the market has been flipped on its head. After years of seeing supply failing to keep up with sky-high demand, we’re now seeing the total opposite. Demand has fallen off while supply is skyrocketing, and prices are tumbling as a result.

“It appears buyers are waiting to see how far prices will fall, before they make a move.”

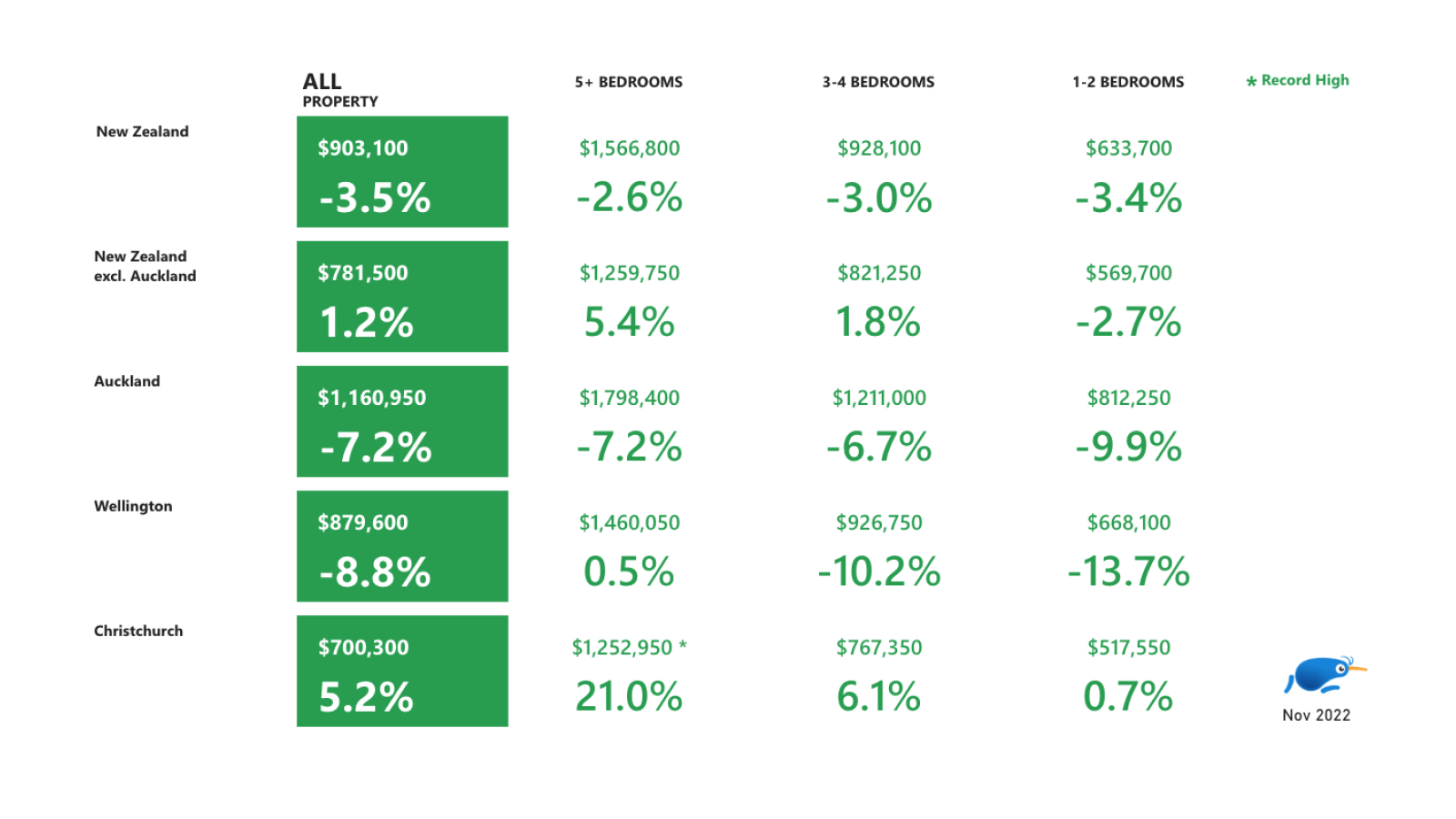

Small property prices fall the furthest

Mr Lloyd said the national average asking price for a small property (1-2 bedrooms) fell by 3 per cent year-on-year in November, to $633,700. “If we break this down further, it’s apparent that small property prices took the biggest tumble in Wellington (-14%) and Auckland (-10%).”

Interestingly, the Christchurch City district bucked the trend, with prices for properties of all sizes increasing year-on-year in November. “Christchurch City even saw a record-breaking average asking price of $1,252,950 for large properties (5+ bedrooms) in November.”