News Next article

Property market kicks off 2023 with a record-breaking price

January Property Price Index 2023

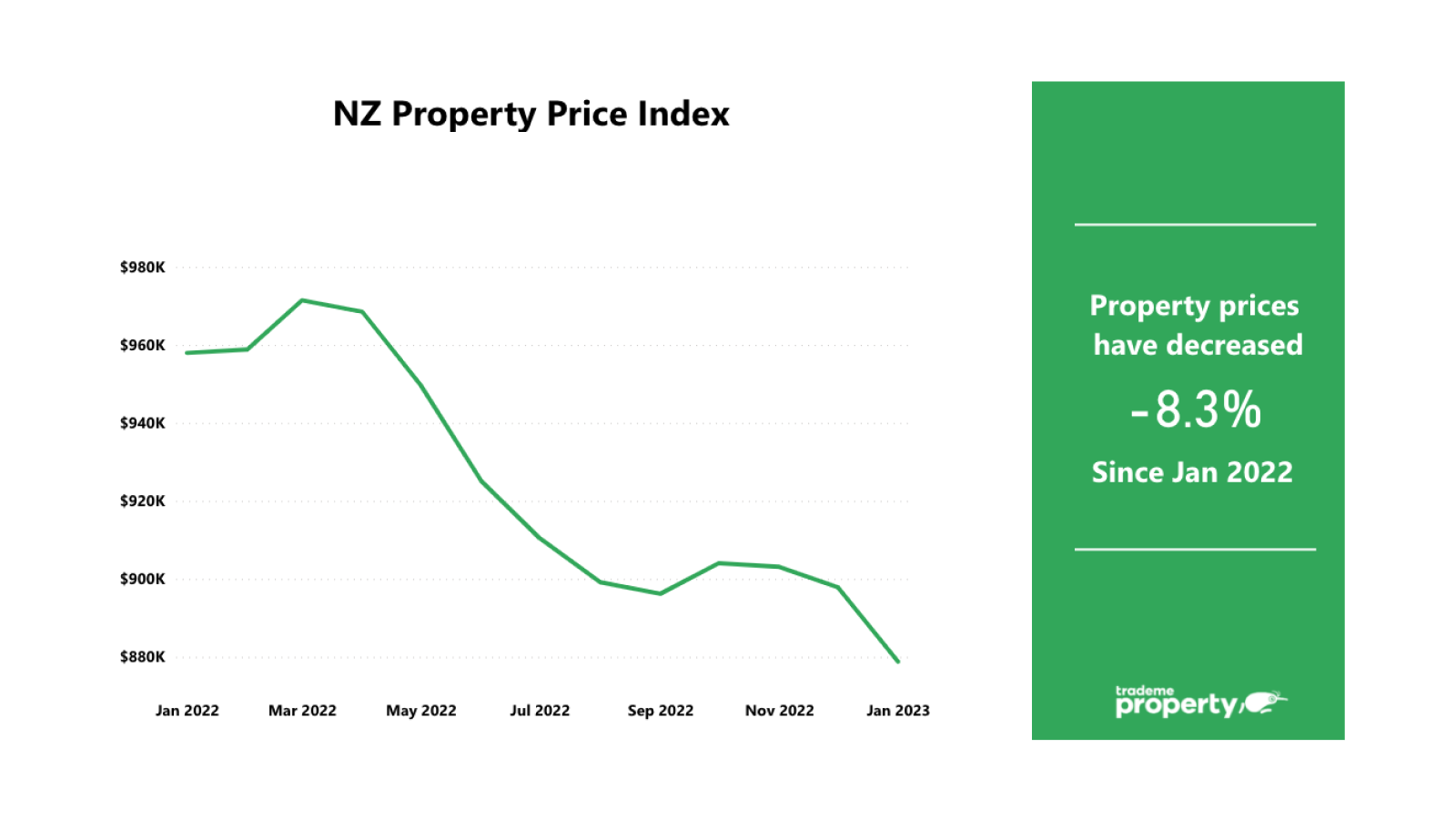

20 February 2023Aotearoa’s property prices continued on a downward trend last month, starting off the year with a record-breaking price drop, according to the latest Trade Me Property Price Index.

Trade Me Property Sales Director Gavin Lloyd said the national average asking price fell by 8 per cent year-on-year in January, to $878,800. “This is the largest drop we’ve ever seen and puts the national average back where we saw it in September 2021.”

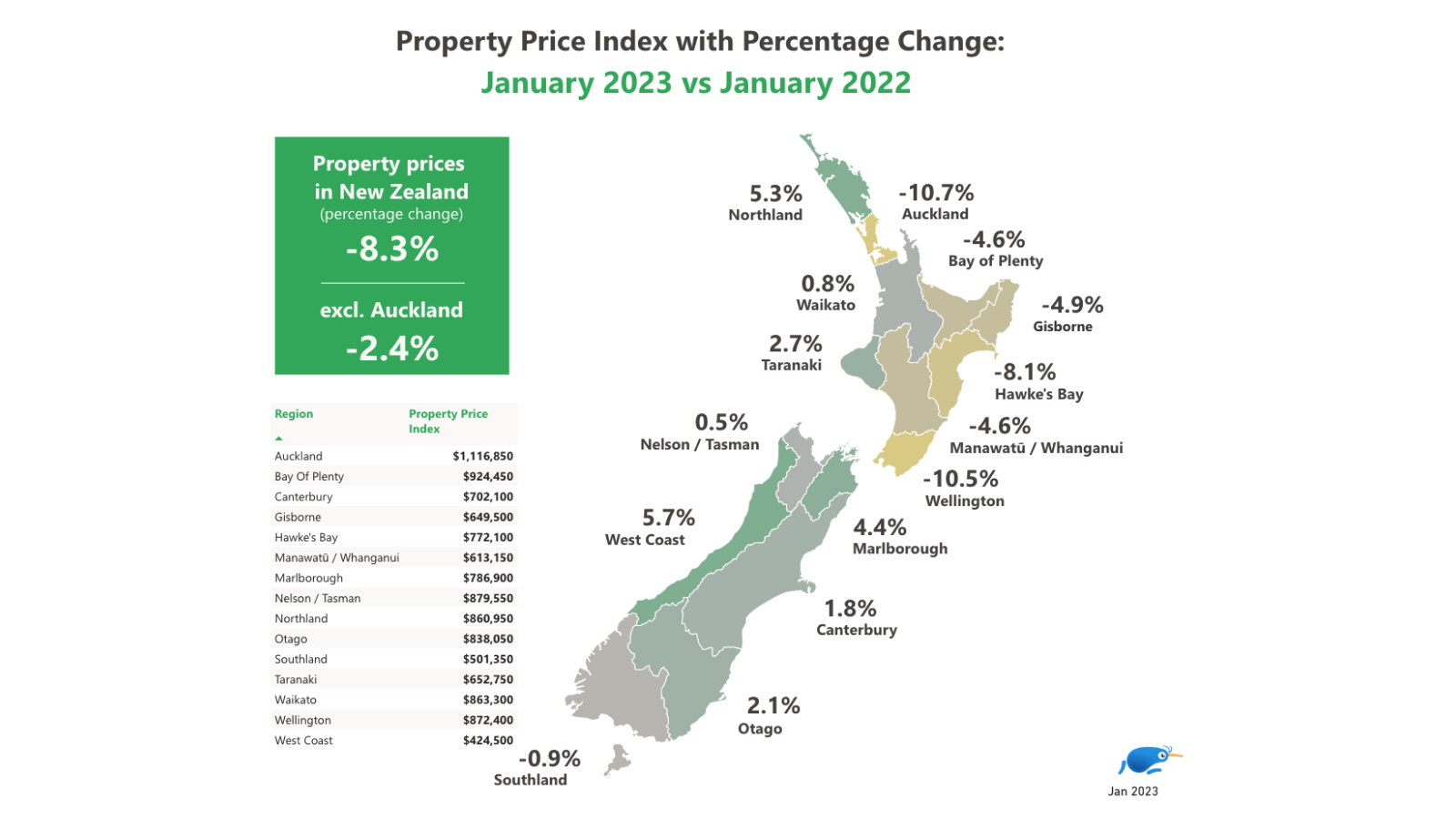

Looking around the country, Mr Lloyd said the main centres took the biggest hit, with the average asking price down 11 per cent year-on-year in both the Auckland and Wellington regions.

“In the Auckland region, the average asking price was $1,116,850 in January, while in Wellington it was $872,400. We haven't seen prices this low in these regions since August 2021. As we would expect, it was those regions who have seen the biggest price gains over the past three years that saw the largest drops in January.”

Mr Lloyd said the Hawke's Bay region’s price drop was a close third, with the average asking price falling 8 per cent in 12 months. “Time will tell how devastating flooding in the region this month will impact the property market going forward.”

However, not every region saw prices cool off in January. “In the North Island, the Northland (+5%), Taranaki (+3%), and Waikato (+1%) regions all saw their average asking prices increase year-on-year. ”

Looking at the South Island, Mr Lloyd said every region, with the exception of Southland (-1%) saw prices climb last month when compared with January 2022. “These increases are still far smaller than what we have seen in these regions over the past couple of years.”

Overall, Mr Lloyd said these latest figures painted a drastically different picture to what we saw in the market this time last year. “It’s almost unthinkable that in January 2022, we saw the national average asking price skyrocket 25 per cent year-on-year, reaching a then-record of $957,950.

“It’s clear that 12 months later the market is in a wildly different place, with property prices now falling year-on-year for three months in a row.”

Record-breaking supply fuels price drops

Mr Lloyd said last month there were more properties listed for sale than in any other January on record. “Nationwide supply spiked by 29 per cent when compared with the same month last year, as we have seen consistently over the past few months.”

While every region saw a year-on-year increase in listings, Mr Lloyd said the Nelson/Tasman region was a standout with supply jumping by 83 per cent.

“Demand, however, went the other way and fell by 5 per cent nationwide last month when compared with January 2022.” The only regions that did not see a dip in demand were Marlborough (+5%), Otago (+4%), Nelson/Tasman (+1%) and Taranaki (+1%).

“We’ve now seen more than 12 consecutive months of sky-high supply combined with slow demand across the country. Going into 2023, prices are going to continue on a downward spiral unless we see market forces change.”

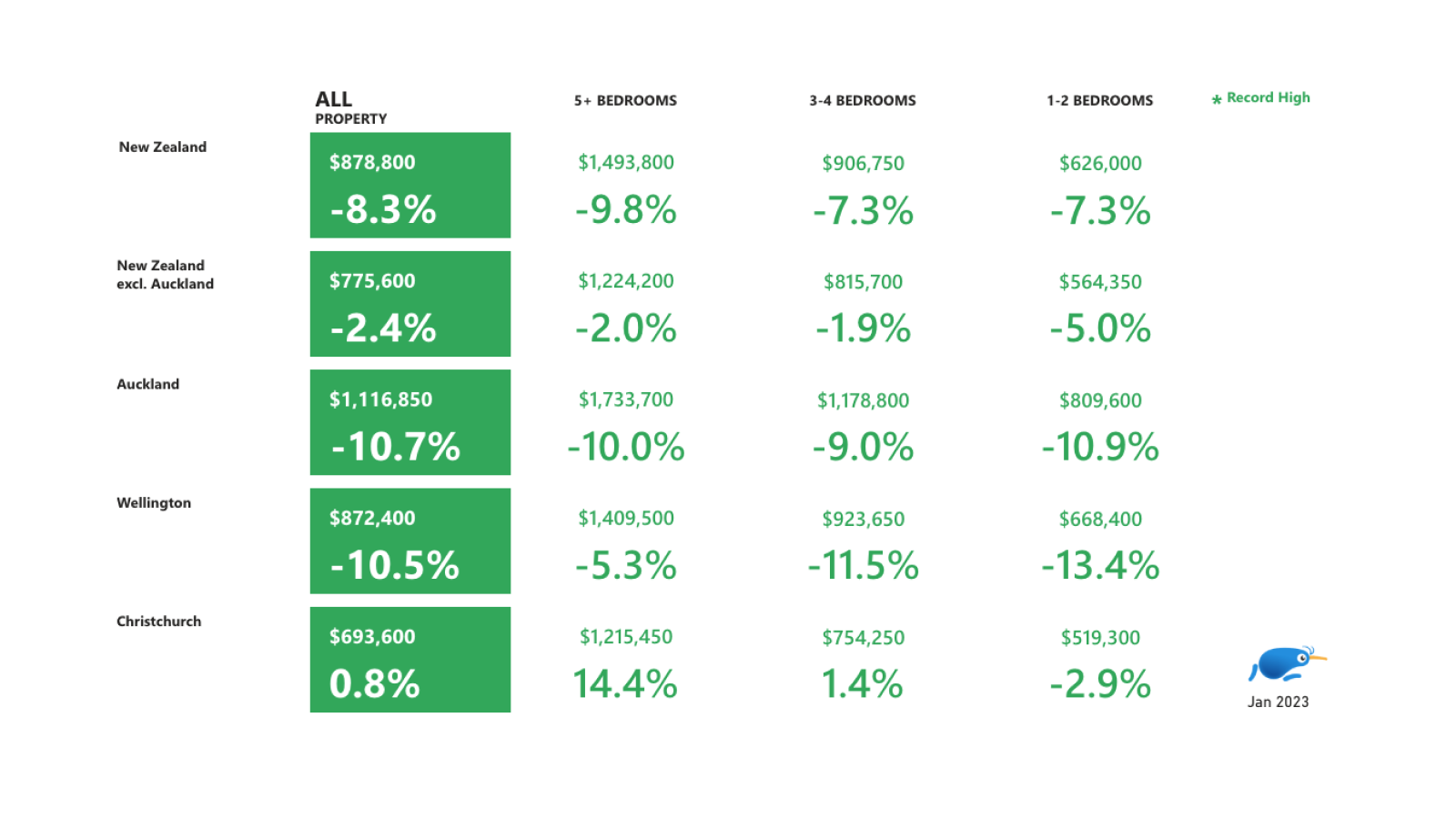

Large properties see bigger price drops

Mr Lloyd said breaking down the listings by property size showed large properties (5+ bedrooms) were the most impacted by price drops. “Small (1-2 bedrooms) and medium (3-4 bedrooms) properties saw their average asking price drop by 7 per cent, while those bigger property prices fell by 10 per cent.”

Although the Auckland and Wellington regions saw similar overall year-on-year price drops in January, breaking down the numbers by property size shows some variance between the markets. “In Wellington, small properties took the biggest hit by far, with their average asking price falling by 13 per cent year-on-year.

“However, this wasn’t the case in Auckland, with price drops comparatively consistent across properties of every size.”

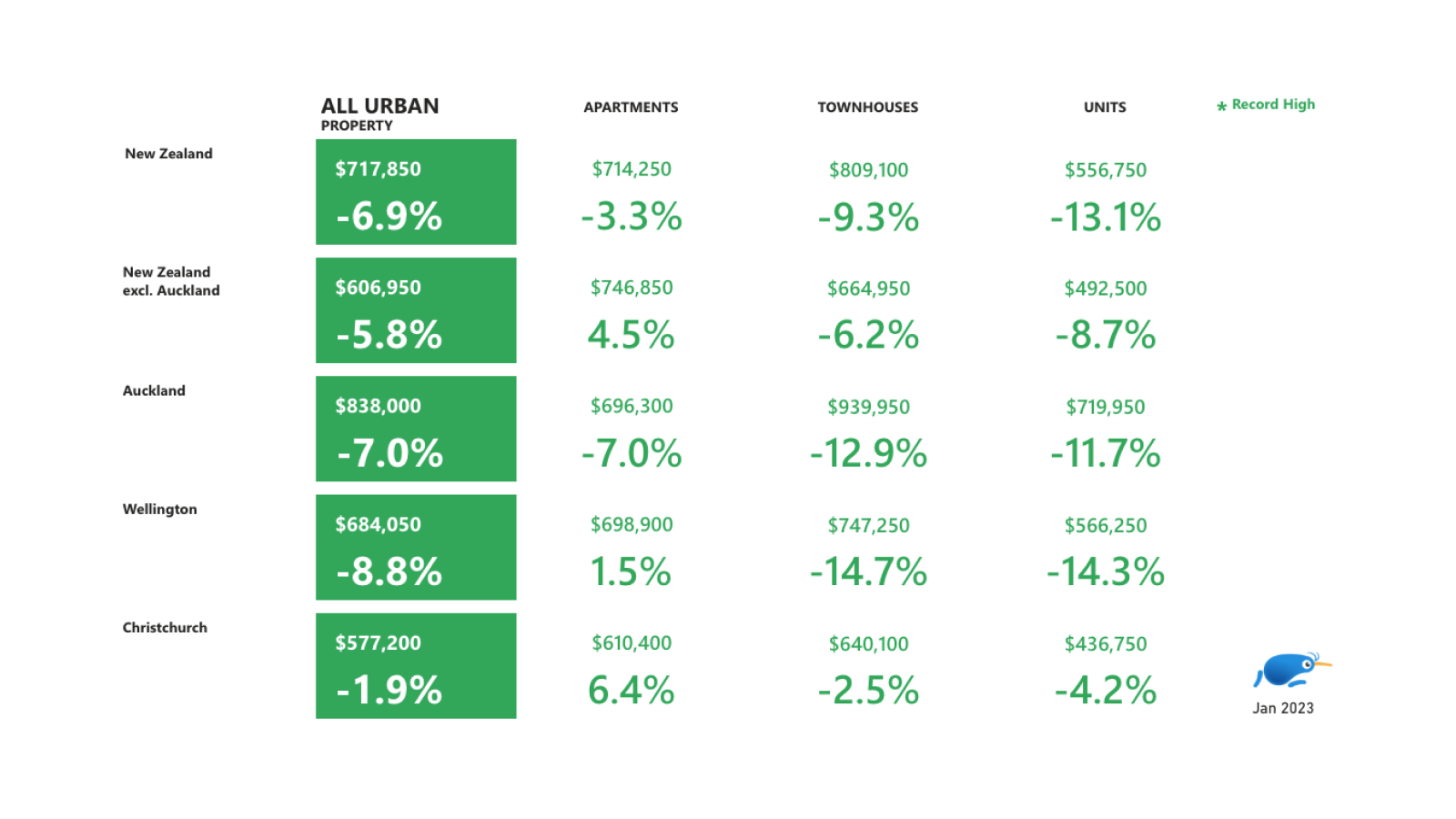

Apartments hold their value

When compared with other property types, Mr Lloyd said apartments held their value in January. “Nationwide the average asking price for an apartment fell by 3 per cent year-on-year last month, while prices for townhouses (-9%) and units (-13%) dropped considerably further.

“In Wellington (+2%) and Christchurch (+6%), the average asking price for apartments actually showed a year-on-year increase in January, while prices for all other urban properties dropped.”