News Next article

Price drops continue while demand follows suit

December Property Price Index 2022

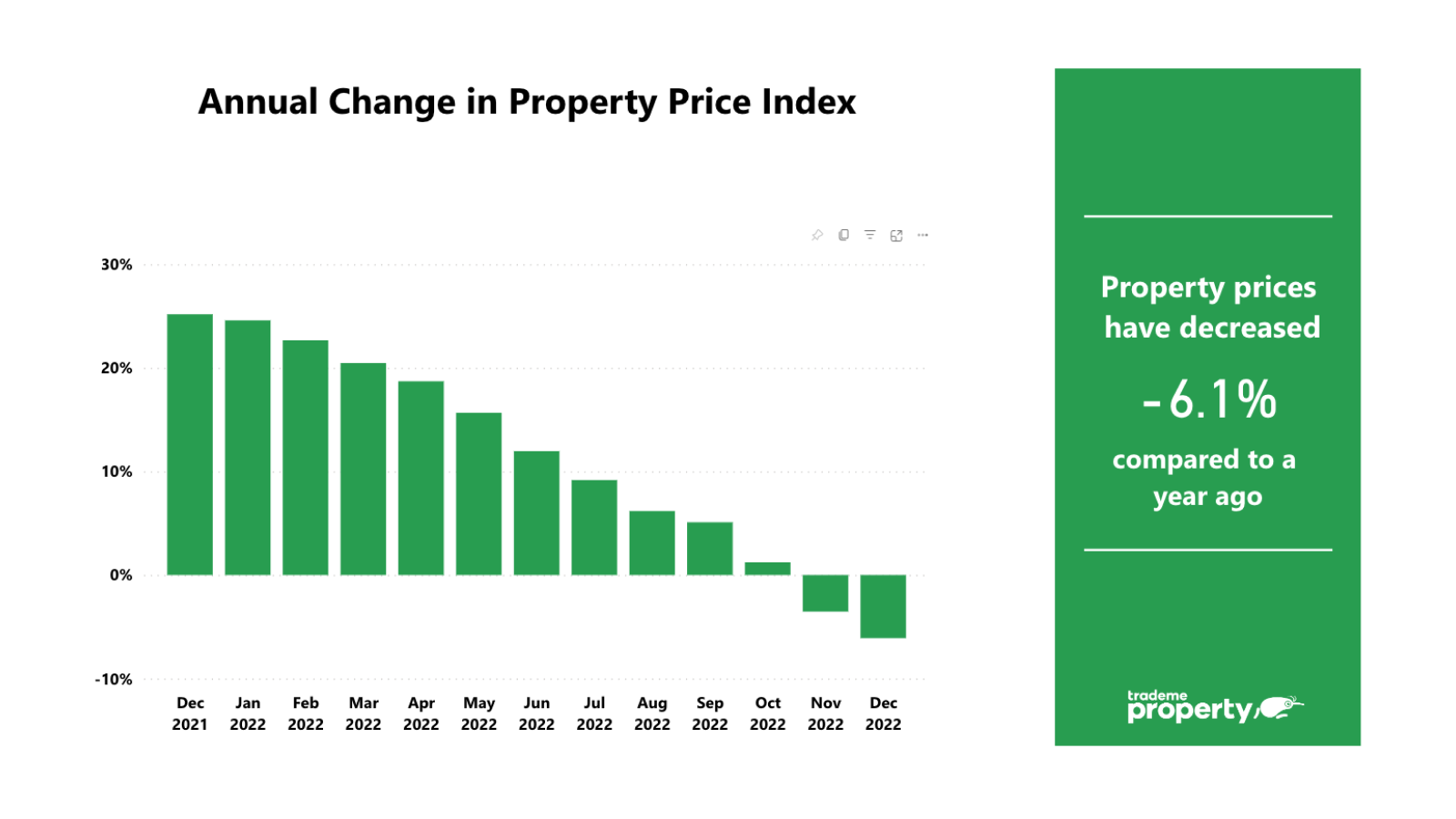

19 January 2023New Zealand property prices fell 6 per cent year-on-year in December, while demand dropped by 11 per cent, according to the latest Trade Me Property Price Index.

Trade Me Property Sales Director Gavin Lloyd said the average asking price for a property in New Zealand finished the year at $897,900 in December, falling by $58,200 in 12 months.

“December marked the second year-on-year drop we’ve seen in a row, with the average asking price falling by 4 per cent in November.

“Prior to that, the last price drop we saw was in March 2018, when the national average asking price fell by 1 per cent when compared with the 12 months prior.”

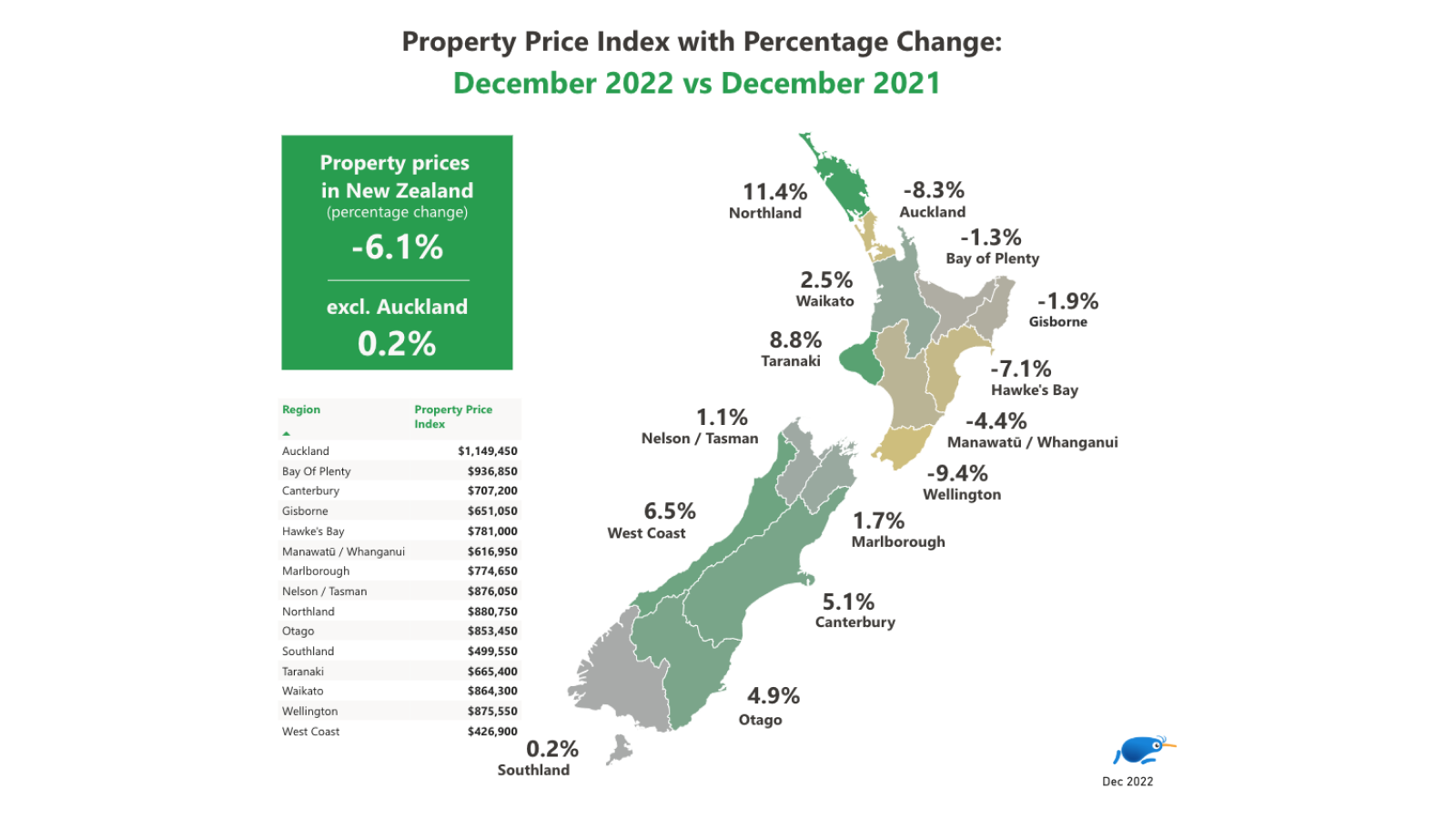

Mr Lloyd said the Auckland and Wellington regions saw the largest price declines. “In the Capital, the average asking price dropped by 9 per cent year-on-year for the second month in a row to $875,550, while in Auckland it fell by 8 per cent to $1,149,450.”

Hawke’s Bay (-7%), Manawatū/Whanganui (-4%), Gisborne (-2%) and Bay of Plenty (-1%) also saw average asking prices drop last month when compared with December 2021.

“This was the first time on record prices have fallen in the Bay of Plenty region, with its average asking price now sitting at $936,850, a whopping $64,700 below its all-time high average asking price recorded in February 2022.”

Mr Lloyd said despite the overall trend, not every region saw prices decrease last month. “Northland was the real outlier, with prices jumping by 11 per cent in 12 months.

“The Taranaki region also saw significant growth, with its average asking price up 9 per cent year-on-year in December, while in Waikato prices jumped 3 per cent. Every region in the South Island saw prices climb year-on-year, too.”

Looking ahead this year, Mr Lloyd said further price drops are likely. “As we come down from the sugar rush we experienced during the pandemic, 2023 is going to be a great time for those that have been wanting to enter the property market but have felt priced out over the last couple of years to look around and consider their options.”

Demand tails off around the country

Mr Lloyd said nationwide demand fell by 11 per cent year-on-year in December. “We always see the market slow down at the end of the year as we enter the silly season and Kiwi head away for the break, but last month demand reached an all-time low around the country.

“After two years of sky-high demand, what we saw in December was typical of the property market pre-pandemic. When compared with the same month in 2019, demand fell by just 2 per cent in December.”

Looking around the country, demand fell in every region except Nelson/Tasman, where it climbed 3 per cent year-on-year. “The biggest drops were seen in the Southland (-22%), Northland (-20%) and West Coast (-17%).”

On the other hand, Mr Lloyd said supply remained strong, with more properties listed for sale last month than in any other December on record. “Nationwide supply jumped 29 per cent year-on-year, with the biggest increase seen in the Nelson/Tasman region (+91%) where it almost doubled in 12 months.”

The Waikato (+61%), Marlborough (+56%), and Taranaki (+50%) regions all saw supply increase by at least half in December.

“In the main centres, supply increases were comparatively small, with the number of properties for sale up 19 per cent year-on-year in the Wellington region and up 15 per cent in the Auckland region.”

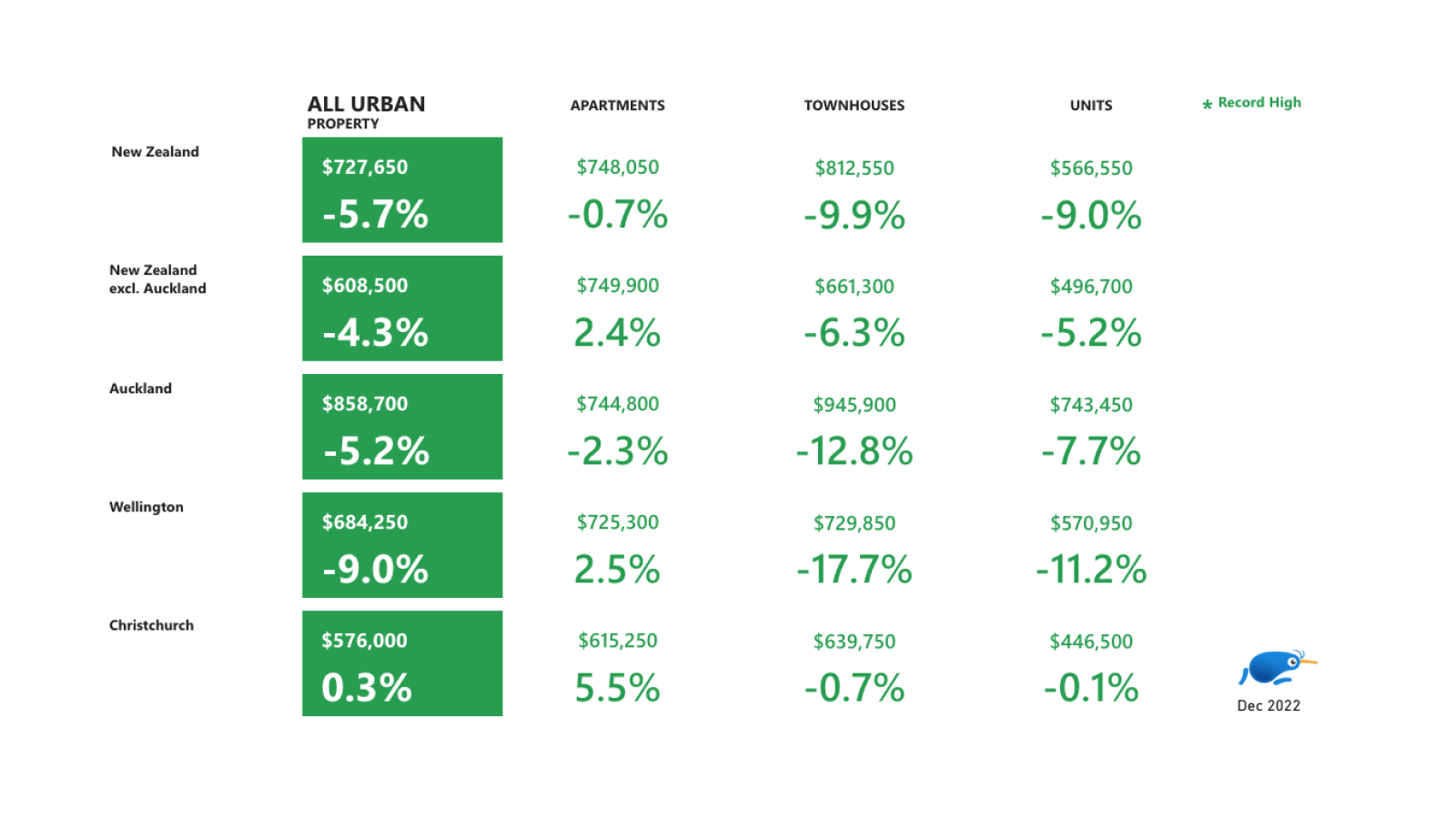

Urban property prices fall by 6 per cent nationwide

Mr Lloyd said the national average asking price for an urban property was $727,650 in December, down 6 per cent year-on-year. “Townhouse prices fell the furthest, down 10 per cent in 12 months, while units (-9%) were not far behind.”

The nationwide price drop for apartments was down 1 per cent year-on-year to $748,050. “In Christchurch City (+6%) and the Wellington region (+3%) the average asking price for an apartment increased in December when compared with the same month in 2021, while in Auckland it fell by 2 per cent.”