News Next article

National rental prices hold despite change in government

November Rental Price Index

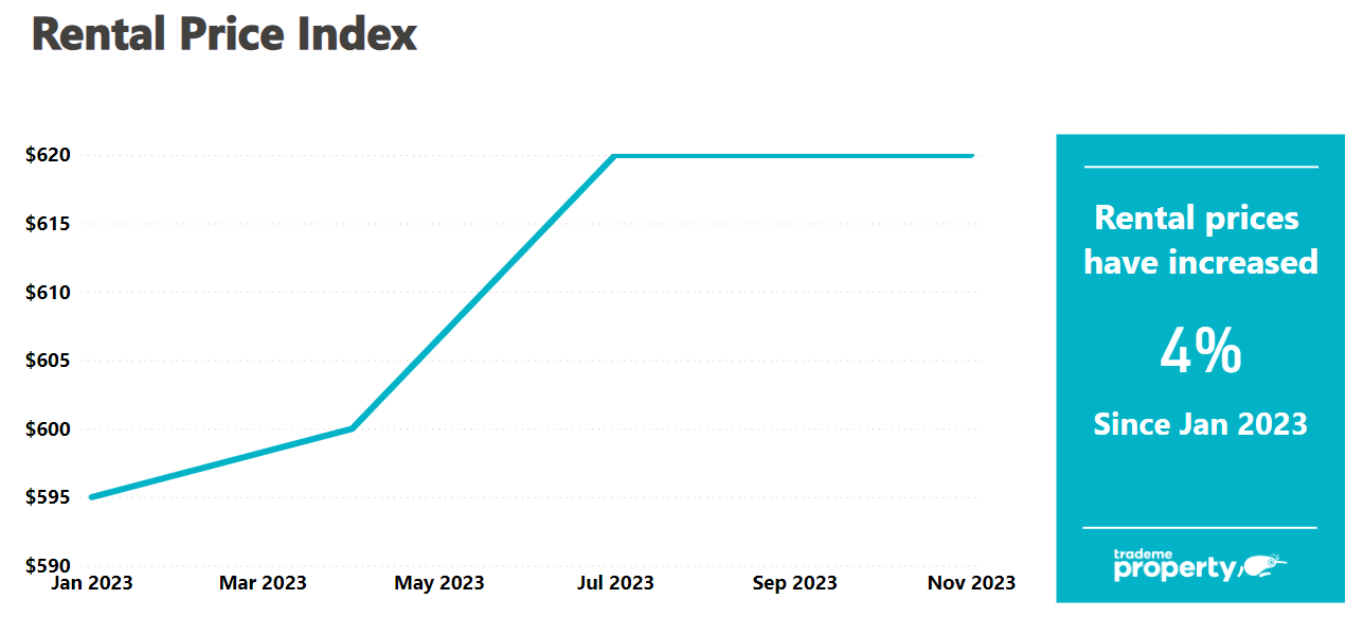

By Gavin Lloyd 7 December 2023Rental prices held steady for the sixth consecutive month, according to Trade Me’s latest Rental Price Index.

The latest data reveals that the national median weekly rent in Aotearoa has maintained its position at $620 for the month of November, where it has stayed since June.

Trade Me’s Property Sales Director Gavin Lloyd says that despite the uncertainties associated with changes in government and interest rates, rental prices have maintained relatively stable.

“While we haven’t seen an immediate impact on the rental market, the new government has outlined their 100 day plan with some long term priorities targeted at upping the supply of rentals,” said Lloyd.

“The biggest impact in the short term is likely to be changes to interest deductibility. This has been brought forward which means landlords can start to claim 60 per cent of their mortgage payments as part of their expenses in 2023/2024 financial year. This tax boost for landlords could help slow rent increases and encourage investors to keep their rental properties rather than putting them up for sale,” said Lloyd

However when compared to November last year, the national median weekly rent was up 6.9 per cent.

Auckland prices drop for first time this year

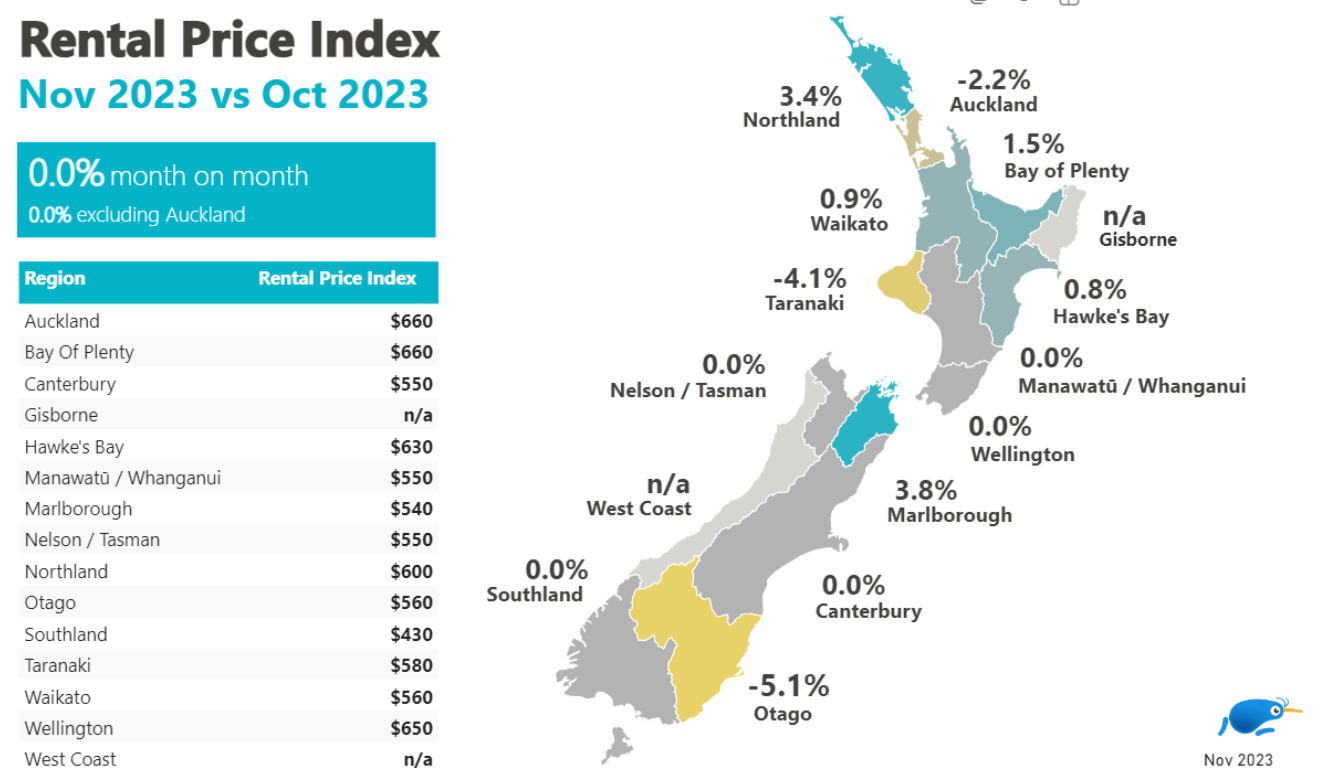

While the national median weekly rent held steady, Auckland experienced a slight decrease compared to October.

For the first time in a year, Tāmaki Makaurau recorded a dip of 2.2 per cent, bringing the median weekly rent to $660. The North Shore (-2.8%), Franklin (-2.3%) and Auckland City (-0.8%) districts all saw rents decline, impacting the region.

“This is not surprising considering we saw Auckland reach an all-time peak last month. We often see the market calibrate after record highs. Otago saw a similar trend dropping to 5.1 per cent to $560 after it peaked last month at $590,” said Lloyd.

“Dunedin saw the biggest decrease in the Otago region with a monthly decline of 6.1 per cent to $540, this drop could be due to the city quietening down when university students head away for the summer holidays,” said Lloyd.

Marlborough experienced the most substantial year-on-year surge in rental prices nationwide, recording a 20 per cent increase. Renters in the region now face a median weekly rent of $540, an additional $90 per week compared to the same period last year.

Large houses in Wellington decrease in value

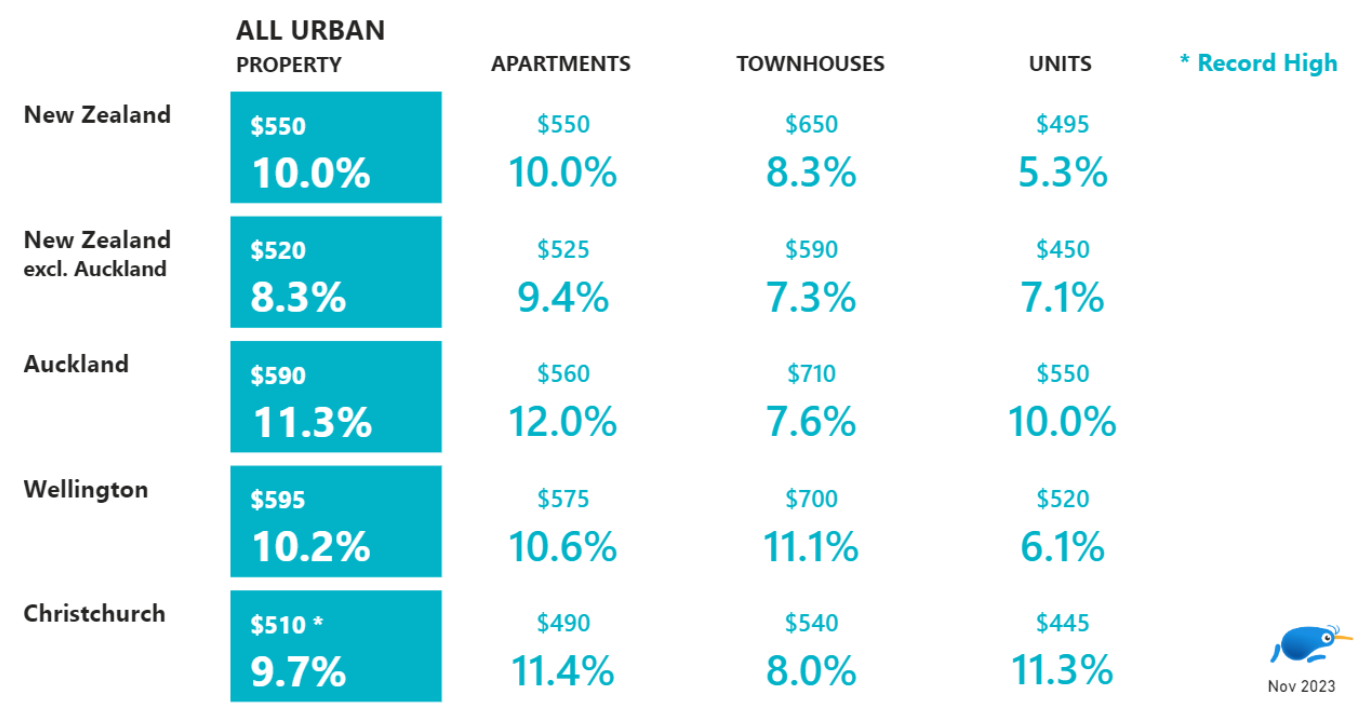

Dwelling sizes in Auckland, Wellington, and Christchurch registered a year-on-year increase, except for larger properties in Wellington.

In Pōneke, the median weekly rent for a property with more than five bedrooms has seen a 4 per cent decrease, now standing at $1,200.

Meanwhile, in Auckland, properties of the same size experienced a substantial surge in November, rising by 16.8 per cent to $1150, marking a record high for the city.

Urban properties in Christchurch have also reached a peak, up 9.7 per cent making the city’s median rent $510 per week.

Gap between supply and demand slowly closing

Nationwide demand for rental properties in November was down by 1 per cent compared to last year while listings were also down by 10 per cent.

However there is still a growing gap between supply and demand in some regions. This is most evident in Auckland where listings have decreased by 16 per cent year-on-year while enquiries have jumped by 12 per cent.

“Waiheke Island has seen the most interest in Auckland as demand skyrocketed by 125 per cent, it’s evident that Kiwi are keen on the island lifestyle over the summer months. However with a small number of properties available renters will need to act quickly to secure a home.”

Author