News Next article

July Property Price Index

Property price declines slow and steady

By Gavin Lloyd 16 August 2023New Zealand property prices continue to stabilise as buyers and sellers wait out winter, according to Trade Me’s latest Property Price Index.

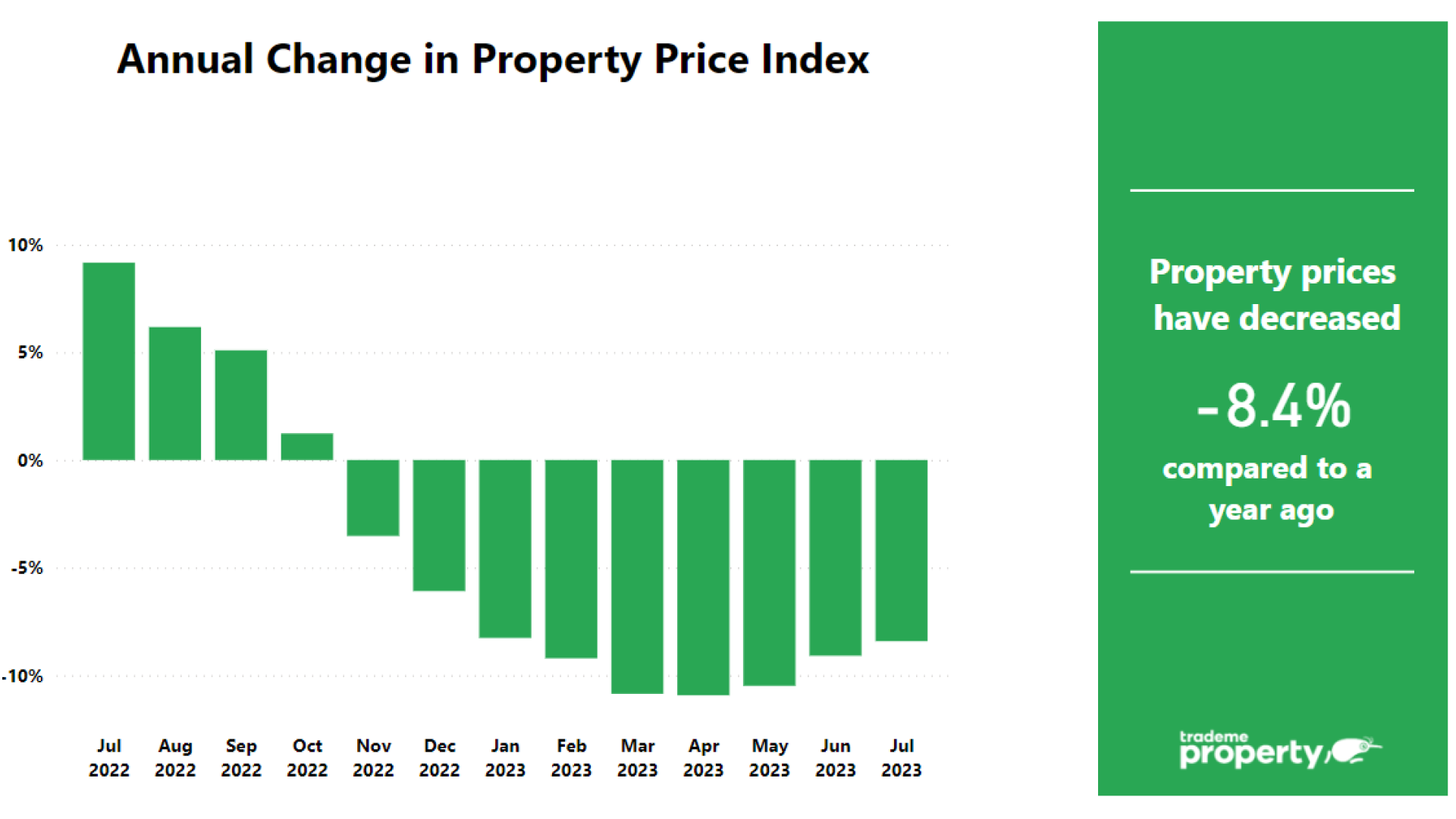

“While the national average asking price is still falling it is at a much slower rate than we saw earlier in 2023, as the market continues to stabilise,” Trade Me Property Sales Director Gavin Lloyd said.

“Property prices have been dropping since November 2022 and in April we saw the biggest year-on-year decline in national average asking price on record at 10.9 per cent or $106,000. However, since then this rate of decline has eased.”

In July, the national average asking price fell 8.4 per cent or $76,600 to $833,850.

“While it’s too early to say that the market is about to rebound, the New Zealand property market is certainly settling from the large peaks and troughs we’ve seen over the past few years.”

With spring just around the corner, Mr Lloyd said he expected the property market to pick up. “Spring is always a busy season for the property market and we expect cashed-up buyers may decide it’s the right time to take advantage of prices.”

Biggest cities seeing the biggest corrections

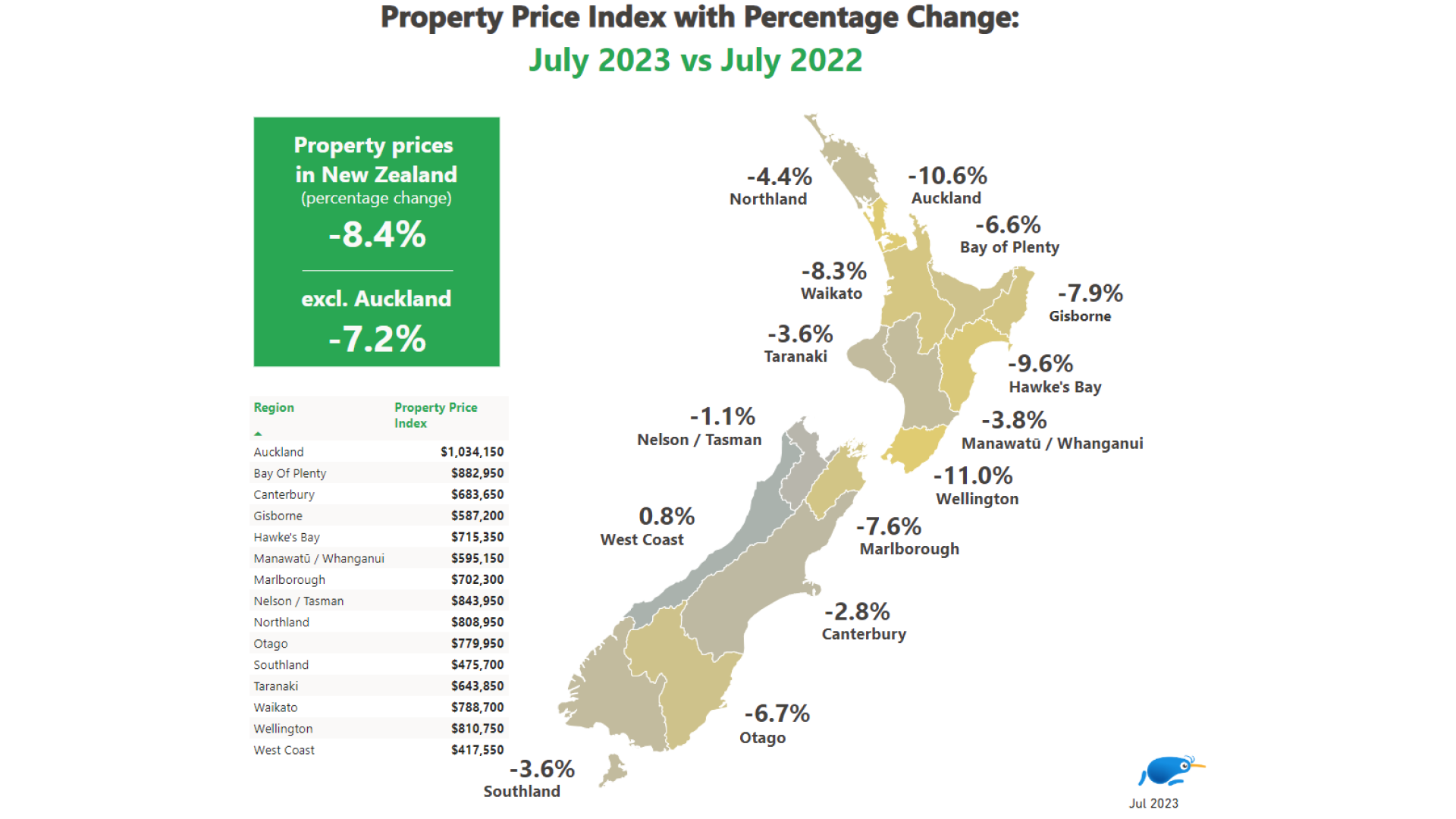

In the main centres, the average asking price in Auckland city fell 11 per cent year-on-year in July; Wellington city saw a 13 per cent drop, and Christchurch only a 2 per cent drop.

“We are still yet to see the average price in Auckland city drop below the $1 million average mark with the average asking price sitting at $1,134,550 in July – but it seems to be steadily coming down which is great news for buyers. Likewise in Wellington city, prospective buyers are now looking at an average asking price of $903,750 - that’s nearly $200,000 less than its peak at $1,088,800,” said Mr Lloyd.

Christchurch saw a 2 per cent decline, with the average asking price in the Garden City sitting much lower at $673,150.

“Ōtautahi didn’t see such dramatic price growth at the peak of the market compared to Auckland and Wellington city, therefore we are seeing much more moderate price correction now,” said Mr Lloyd.

The most expensive regions in the country in July were Auckland with an average asking price of $1,034,150, Bay of Plenty at $882,950 and Nelson/Tasman at $843,950.

Supply and demand cool in July

Supply and demand was down in July as many buyers and sellers waited out the wintry month. We saw 10 per cent fewer listings and 7 per cent fewer views compared to the same time last year.

“There are definitely fewer properties on the market compared to what we saw at the peak. However, stock is not at record lows and this is typical of what we see in the lead up to an election as many sellers wait to see which way the votes go.

“From a demand perspective, Kiwi property enthusiasts are still tracking what’s on offer at levels we’d expect given the high mortgage rates, cost of living crisis and time of year,” said Mr Lloyd.

“We’d expect more properties to be put on the market after election day, and I think we might start seeing property prices flatten before 2024 rolls around.

“People might be biding their time, but in this market potential buyers should still keep an eye on things, as before the end of the year, the market could be in quite a different state.”

Price declines for smaller homes and apartments good news for first home buyers

The demand for apartments, townhouses and units in the main centres continues, but with prices generally coming down.

“Apartments in our main centres remained in the $600,000 range making these a great entry level property for those looking to get into the market,” said Mr Lloyd.

In July, the average asking price for an Auckland apartment dropped 3.2 percent to $656,300, Wellington went down 6.7 per cent to $676,700 and Christchurch went up 4.2 per cent to $631,600.

“Christchurch apartment prices were the only urban property type to increase in July. It seems like these prices are moving to relatively even levels across the urban property market to compete with the other main centres,” said Mr Lloyd.

Elsewhere, New Zealanders saw a 9 per cent decline for 1-2 bedroom homes, and a 8.7 per cent decline for 3-4 bedroom homes.

The biggest decrease was in Auckland where the average asking price for 1-2 bedroom homes dropped 15.1 per cent.

“Lower average prices for smaller homes is promising news for first home buyers, who are most often singles or couples looking for just one or two bedrooms. This trend will be watched with interest and optimism for those trying to get on the property ladder,” said Mr Lloyd.

Author