News Next article

Aotearoa’s six figure house price plunge

March Trade Me Property Price Index

26 April 2023The national average asking price dropped over $100,000 over the past year, according to the latest Trade Me Property Price Index.

Trade Me Property Sales Director Gavin Lloyd said the latest figures show the average asking price fell from $971,450 in March 2022 to $866,000 last month - the largest annual drop on record, and the fourth consecutive month of price drops.

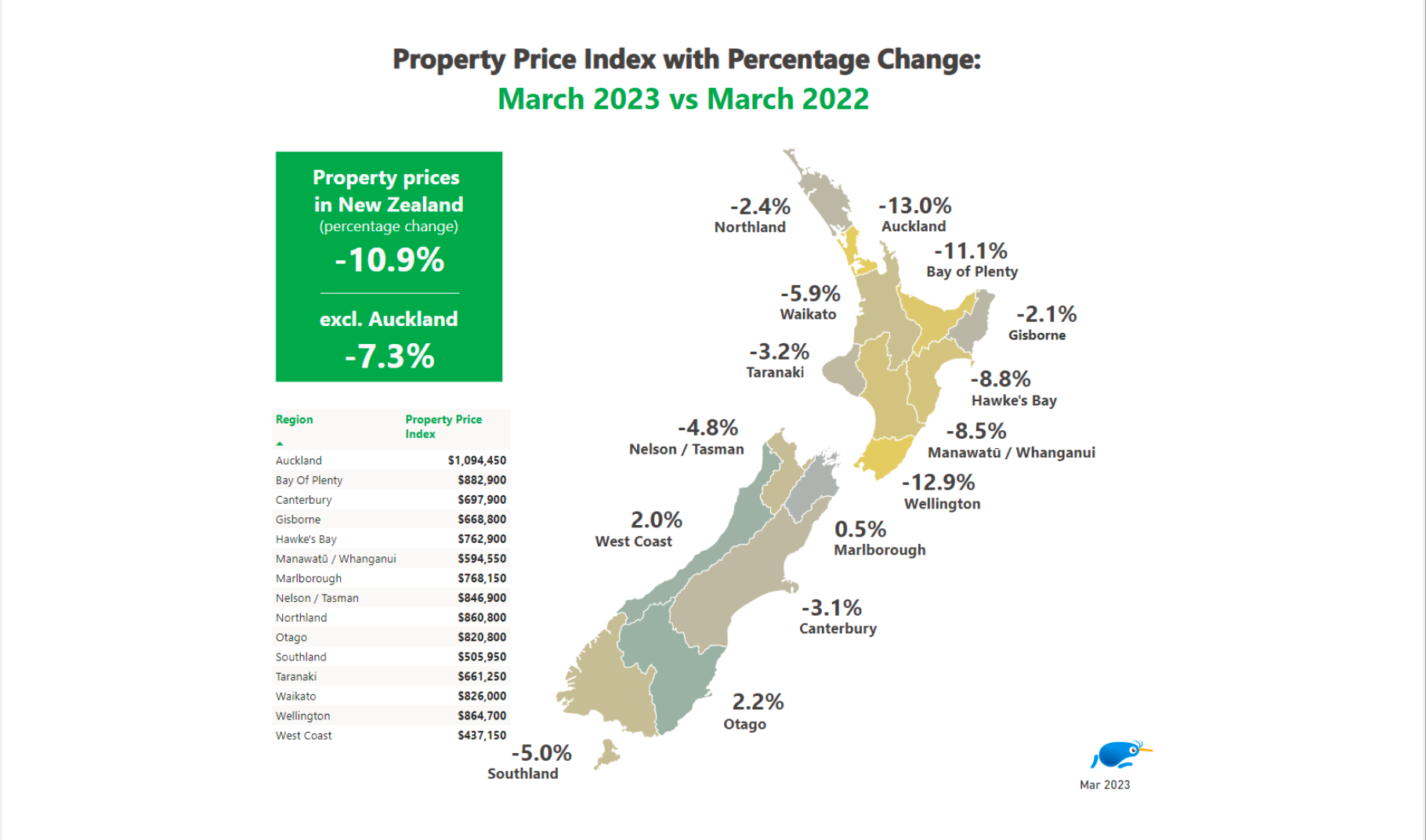

“When we take a look across the motu, the drops were particularly apparent in the regions which have had the biggest rises over the past few years.”

Te Whanganui-a-Tara plummeted by $128,000 (-13%), while Tāmaki Makaurau had $164,000 (-13%) knocked off its average asking price.

“The Wellington and Auckland property markets have been running red hot post the first Covid lockdown in 2020, so it’s unsurprising that these regions have seen the sharpest drops.”

The Hawke’s Bay, Bay of Plenty, Manawatū/ Whanganui, and Waikato markets also had decent chunks knocked off when compared with March 2022, Mr Lloyd said.The March 2023 figures showed Bay of Plenty fell by $110,000 to $883,000 (-11%), while Hawke’s Bay

swooped $73,000 to $763,000 (-9%). Manawatū/ Whanganui had $55,000 knocked off the average asking price to $595,000 (-9%), and the Waikato fell $51,000 to $826,000 (-6%).

“We are still seeing a market that’s correcting itself after the huge gains made in the past few years. The national average has dialled back to similar levels we saw at the end of 2021, and with the OCR rising yet again, we expect these drops should continue for a little bit longer.”

“There's even more good news for buyers. Not only did prices fall in March, so too did demand (down 12 per cent year-on-year) while supply saw an increase (up 7 per cent year-on-year).

“When there are more options to choose between and less competition looking at properties, those in the market to buy have greater negotiating power.”

However, some of the smaller regions; Marlborough (+1%), Otago (+2%), and the West Coast (+3%) bucked the trend, and increased their average asking prices, Mr Lloyd said.

Still gains to be made in Christchurch apartments

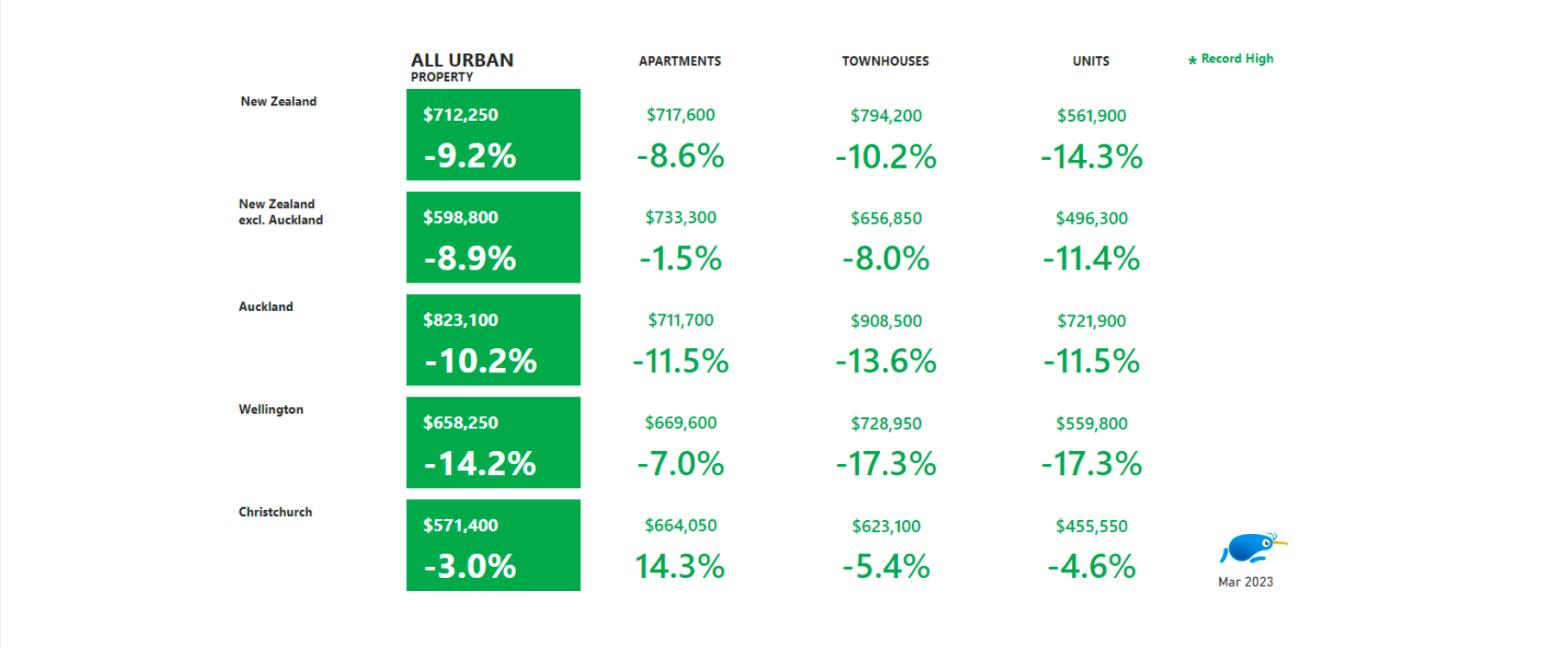

The anomaly we saw in the mix was a sharp rise in the average asking price of Christchurch apartments, Mr Lloyd said.

“In the past year, the price for an Ōtautahi apartment rose $95,000 (+14%) to $664,000. While this is a substantial jump, if we look back over the past couple of years, Christchurch saw the lowest gains of any main centre,” Mr Lloyd said.

“We are changing the ways we live our lives. Kiwi want smaller places with less maintenance, and we’re living our lives quite differently to how they did a generation ago - and an apartment is an attractive choice for a lot of people now. Christchurch is just catching up to the rest of us.”

So, what does all this mean?

“We are seeing a lot of shifts in the property market, not just the average asking price, but also how properties are being marketed and sold.

“In a hot market, there tends to be less price transparency which means a lot more auctions. However, today we are entering a phase where properties are spending longer on the market, people are taking their time to make considered purchases and want more information up front. This means price transparent sale methods like ‘enquiries over’ or ‘price by negotiation’ are making their way back onto the listings.

“It is a good time to buy, just do your research, speak with a local agent who knows the area and if in doubt seek financial advice. You may still be able to buy your Kiwi dream,” Mr Lloyd said.