Buying guide

Explained: What is the OCR?

What the OCR is and how does it affect buyers and homeowners?

5 April 2023

What you’ll learn:

- What is the Official Cash Rate (OCR)?

- Who sets the OCR?

- How does the OCR affect mortgage holders?

- What is the current OCR?

Jeanette Thomas explains the OCR

What is the OCR?

The OCR is the interest rate set by the Reserve Bank’s Monetary Policy Committee to influence the price of borrowing and saving money in New Zealand. The OCR, reviewed seven times a year by the central bank committee, influences the level of economic activity and inflation in Aotearoa. The Reserve Bank also supports “maximum sustainable employment”, in other words full employment, keeping a close eye on wage inflation when unemployment is at very low levels.

The OCR was introduced in March 1999, a system with a series of 25 and 50 basis point steps to manage short-term rates, a tool to help control inflation, which is measured by the Consumer Price Index.

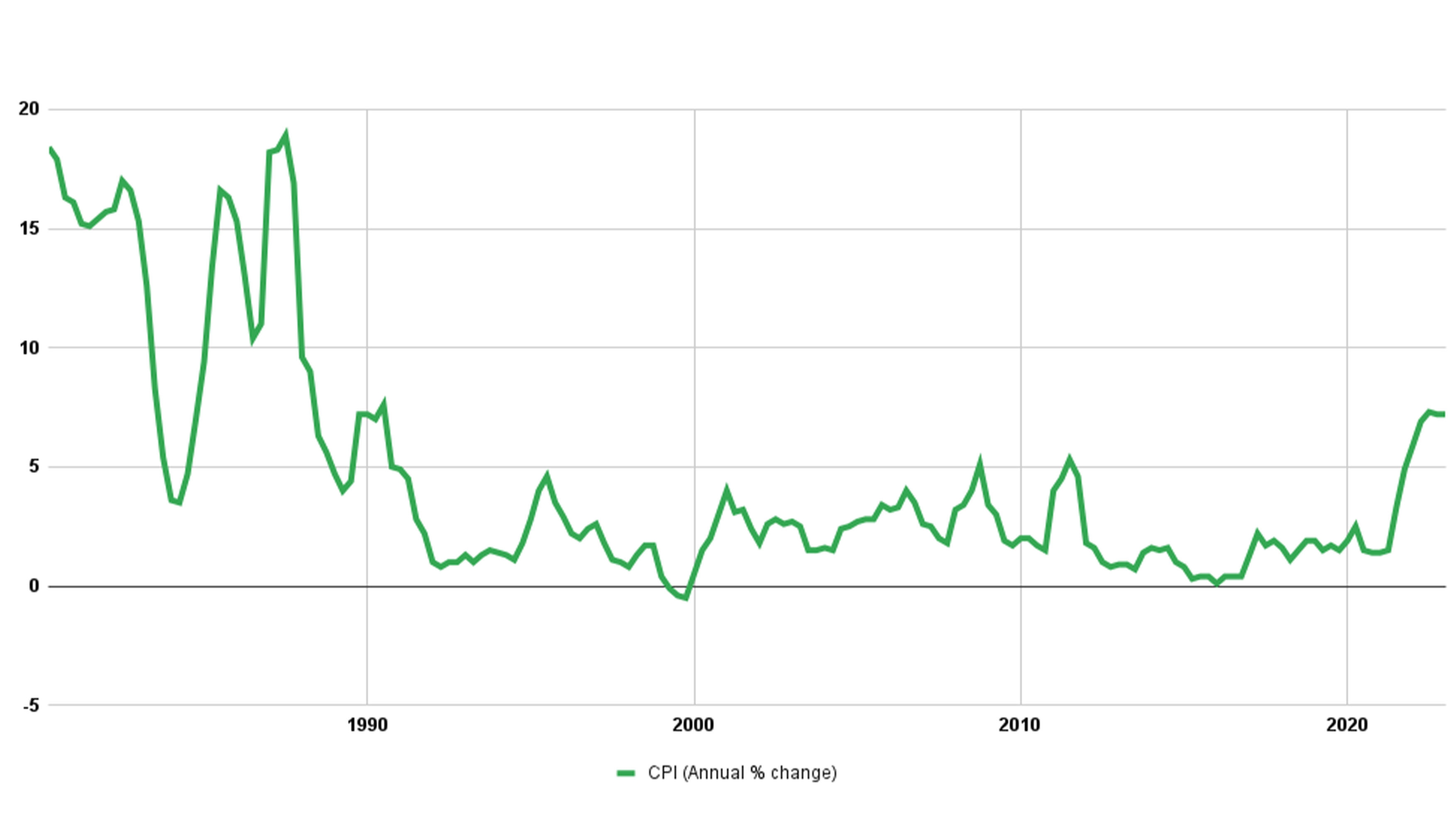

The OCR is used to manage inflation which saw a steep increase following the pandemic in 2020.

The OCR is the interest rate for overnight transactions between banks, this interest rate defines the wholesale price of borrowed money. It directly affects the commercial banks, determining the rates they, offer their customers. It influences the rates that banks then charge for borrowing – mortgages, loans, credit cards – as well as what they pay customers who are saving in term deposits or savings accounts.

When the Reserve Bank raises the OCR, it slows spending in the economy, and people are more inclined to save by cutting back on goods and services. Higher interest rates usually lead to higher exchange rates too which makes it cheaper to buy foreign products and lowers inflation.

The higher exchange rate also makes our exports more expensive for people overseas so helps lower export revenue and helps slow demand for goods and services in the economy.

The OCR has the most impact on floating rates and shorter term fixed rates. The Reserve Bank admits: “Monetary policy is a blunt tool and impacts the economy with a time lag.”

Why does the Reserve Bank raise the OCR?

The Reserve Bank Governor, Adrian Orr has been raising interest rates since October 2021 to bring inflation back down.

The bank’s Monetary Policy Committee looks at a number of economic indicators including the Consumer Price Index, Gross Domestic Product (GDP) figures, and unemployment rates to make its decision on how it sets the OCR.

On top of this, the Committee considers a range of labour statistics to gauge if the country is at full employment and if wage inflation is a concern. In a tight job market wage inflation is likely and may become unsustainable.

The OCR is a way for the Government to keep inflation at an acceptable level.

How does the OCR affect people with home loans?

The OCR impacts the cost of borrowing money from the bank. The biggest borrowers are those with home loans, so they tend to be the most heavily impacted.

Usually when the OCR goes up, so too do mortgage interest rates - but not always. The banks and lenders may be aware that the OCR rise is coming and factor it into their pricing ahead of the announcements.

With a rising OCR, many people will face higher borrowing costs when they re-fix their loans. If they have a portion of their loan on a floating rate, they will definitely feel every OCR rise as this rate goes up in tandem. These higher costs of borrowing will force them to find extra cash for their repayments, and will often result in them tightening their discretionary spending. This is the ultimate goal of the Reserve Bank in order to keep inflation under control.

With increasing borrowing costs, people tend to cut back on their spending.

Author

Other articles you might like