Feature article

Top 10 reasons why property can make a great investment

Just like any investment, you need to make sure you have done your homework.

Last updated: 2 May 2024

1. Historical returns

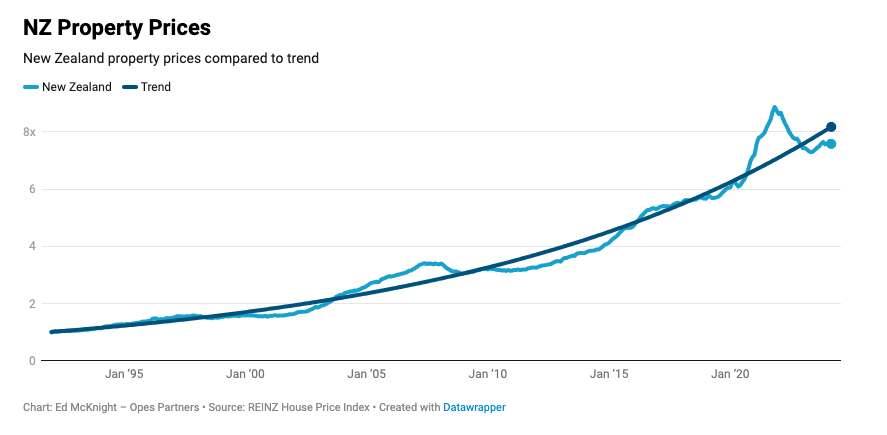

In New Zealand, house prices typically double in value every 10 years. This means a $700,000 house in 2013, would be worth about $1.4 million today. That’s amazing!

Why? New Zealand is a place lots of people want to live - politically, economically and socially it’s pretty solid compared to a lot of the world, especially right now. This means there is a lot of demand for houses. We can’t actually build fast enough to keep up with the demand which means prices have steadily increased overtime.

You can see from the below, even though house prices have fallen in the last few months, over the long-haul, they increase.

Image source: https://www.opespartners.co.nz/property-markets

2. Leverage

This is probably one of the KEY differences (and amazing features!) of buying property as an investment versus stocks. Leverage is just a fancy word for debt or borrowing money. If you are using ‘leverage’, you are using debt (or you have a mortgage) to purchase your property. This means you don’t have to save up the entire property price amount of $885,100 (the average house price in NZ in March 2024), you only need to save a portion of this which is the deposit and you can leverage or borrow the remaining amount.

3. Diversification

The four different asset classes (stocks, bonds, property and cash) have different levels of risk and return. Therefore for those who already have cash in the bank or KiwiSaver, buying property can be a great way to spread around your money and diversify, one of my favourite investing terms. Having a diversified portfolio means that if one asset class isn’t doing very well, the totality of your portfolio isn’t hit so hard.

For example, if all of your savings were invested in the stock market, and the stock market fell by 20%, so would your investments. You would effectively (if you sold your shares when the market was down 20%), lose 20% of your savings. Yikes. Whereas if you had used some of that $ to buy property as an investment and the property market was doing well when the stock market wasn’t doing so well, the return of your portfolio would be quite different.

You can see below, the return over the last 5 years for the NZX 50 (top 50 companies in NZ) is 18%.

Image source: Google Finance

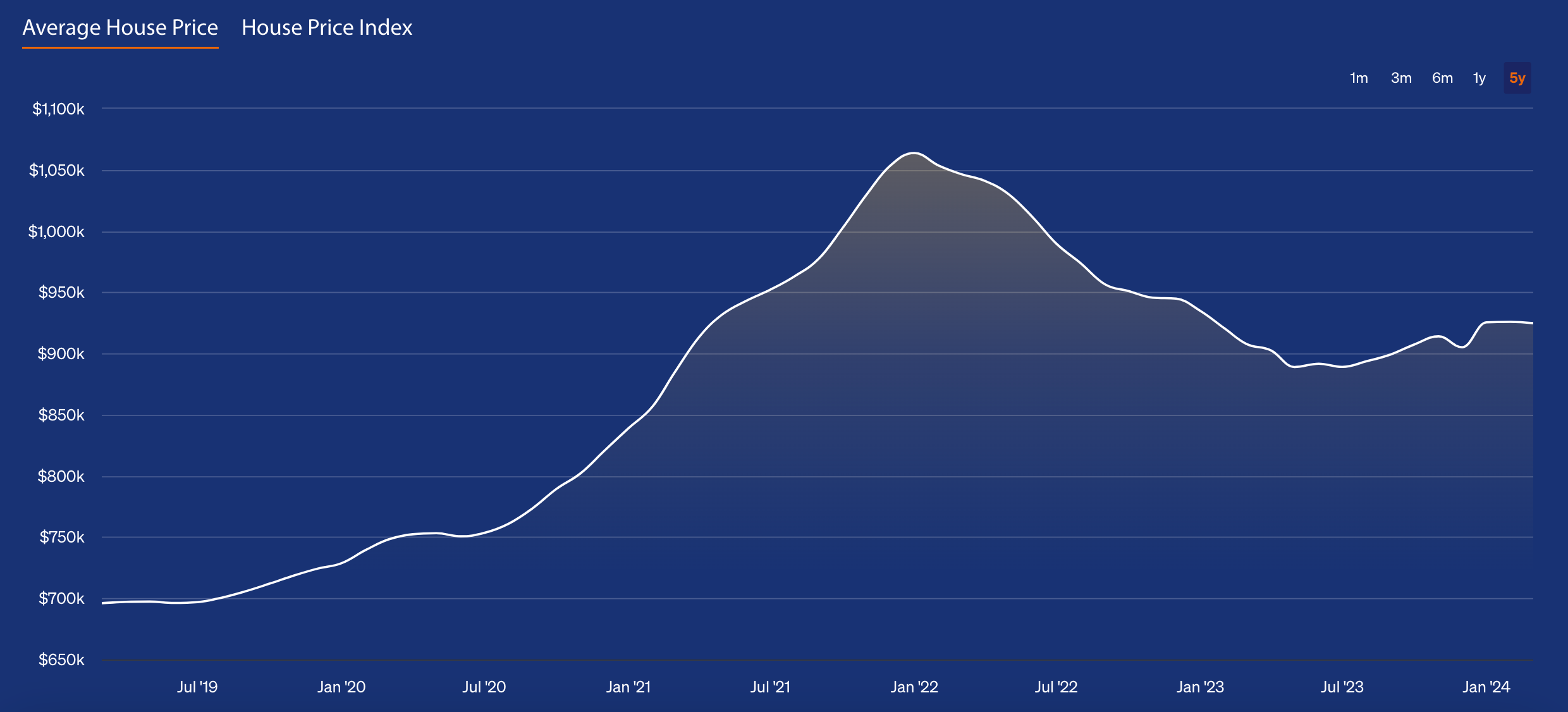

If we look at the same time period for the NZ residential property market, it has increased 30% as house prices have risen from NZ$697k to NZ$924k.

Source: https://www.qv.co.nz/price-index/

4. Not paying rent

‘Why am I paying someone else’s mortgage’. If you don’t own your own home, this is what you're doing - you’re paying someone else’s mortgage and helping them to get ahead.

The median weekly rent in Auckland is $690 per week as of March 2024. The repayments on a $700,000 mortgage at 7% = $1,000. It’s definitely more than renting, but you get to benefit from the long term gains of owning the property. Whereas when you rent, you don't benefit from the increase in value or price in your landlord’s home.

The moral of the story? You may as well be paying off your own mortgage, rather than your landlords!

5. Capital for dream opportunities

Once you have paid down some of your mortgage, or if the price of your house has increased over the time that you’ve owned it, you can withdraw some of the money (if you want to). You might be thinking… why on earth would I do that? Essentially it just means that if you needed or wanted that money for other things e.g to start a business, go on a dream overseas trip, or renovate - you have the opportunity to do so.

6. Stability

Imagine getting a knock at the door from your landlord saying you have 90 days to leave your home - stressful!! If you own your own property, this doesn't happen. You can live in peace knowing that you only have to leave when and if you want to.

Plus if you look at the graphs in the historical returns (above), you can see that property prices are much more stable than the stock market. They move around less and this is because shares are priced daily, whereas property is not. You don’t get an envelope in your letterbox everyday saying what your property is worth! Property is arguably a more stable investment - it’s not to say the property market always goes up, like any investment it has the possibility of going up and down. However traditionally those ups and downs are much less frequent than in the stock market.

7. You can change it up

You can paint the walls green. You can put in some funky lampshades. You can tear down the walls. When you own property you can make it your own - you can do with it what you like! Of course renovating is expensive and time consuming, but you can decorate and create a space that feels unique to you.

A home is a place of course, but it is also a feeling. Sometimes you don’t get that when you’re in someone else's home with their stuff everywhere. The beauty of owning a home is being able to take responsibility for what it looks like, and how it feels to be inside it. How special is that!

8. A place to call home

If you want to travel, you can rent your place out and you’ll always have somewhere to come back to. The idea of not having to come home from being away having to fight to get back into the rental market is an actual dream. If you’ve been a renter for some time, you’ll know that finding the perfect place, with the perfect flatmates and in the perfect location is time consuming and stressful.

Owning your own home completely eliminates the idea of ‘needing to find a home’ or a place to live should you go away and come back again.

9. You can have pets!

How many of you have pets? And how many of you have been turned away from rental properties because of it. When you don’t have to deal with landlords, you can have 15 cats and 17 puppies if that’s what your heart desires.

There are no pesky landlords telling you you can't have animals. This is a BIG perk for dog-lovers like myself.

10. Pride & independence

This point is kind-of self explanatory. You’ve worked hard for the property - so enjoy it! You have your own space to be yourself, entertain friends and family, and to come home to after a big day.

There is an extreme sense of pride and achievement that comes with purchasing your own home - a feeling you could know soon enough.

Financial Disclaimer

The Curve and The Curve Classroom course has been prepared solely for informational and educational purposes. Any information provided and serviced described in this website are intended to be of general nature and provide general information only. The opinions expressed by The Curve do not constitute investment advice and are not to be viewed as investment or financial advice. It does not take into account your investment needs or personal circumstances. Independent advice should be sought where appropriate. Should you require financial advice you should always speak to a Financial Adviser.

Author

Other articles you might like