Feature article

Are housing prices in New Zealand close to the bottom?

House price falls have been a constant in the housing market for the past 18 months but are they coming to an end?

29 May 2023

For real estate buyers and sellers watching the property market closely, many are trying to time when to make their move. As a seller, it can be unsettling bringing your house to the market when you think prices are going to keep falling because you’re afraid buyers will make low-ball offers. And as a buyer, the last thing you want to see is the property’s value continue to hurtle downwards after you’ve bought.

So when the real estate industry says the bottom of the market has been reached, it’s a big moment for the confidence and activity of buyers and sellers.

And while we’re not quite there yet, Trade Me Q1 Property Pulse Report has some encouraging news of early signs of the market plateauing with fewer homeowners and buyers thinking house prices will fall in the next 12 months.

Source: Trade Me Property Q1 Pulse Report

In our April survey of over 7000 homeowners and more than 600 buyers, the proportion of homeowners who think house prices will decrease in the next 12 months has fallen (Q1 2023 38% vs Q3 2022 40%) and the percentage of buyers who think house prices would decrease in the next 12 months also fell (Q1 2023 47% vs Q3 2022 49%). At the same time, 55% of property seekers are thinking now is a good time to buy.

“Declines in property values are slowing and as we approach the end of interest rate rises, this gives promise that buyers and sellers will both have more certainty as we head out of the winter months,” says Gavin Lloyd, Sales Director at Trade Me Property.

“House prices may drop a little bit more, however once again, I believe we are near the bottom of the market,” adds Paulette Trotter, Loan Market mortgage adviser.

CoreLogic chief property economist Kelvin Davidson describes the housing downturn as on its last legs but still not finished yet. And even if the market reaches its bottom, an immediate or strong upturn in this environment doesn’t seem likely either, he cautions.

“It’s not optimism but less pessimism,” he says. “The idea that you can see the end but we’re not quite there,” he adds.

Bottom of the market already here, say Wellington and Dunedin experts

While it may be too early to call in every city, some real estate agency firms are picking the bottom has already been reached in some key cities including Wellington and Dunedin, Auckland, Tauranga and Hamilton.

Wellington was one of the first of the big city markets to feel the house price correction in late 2021 and sales director Nicki Cruickshank at Wellington agency Tommy’s Real Estate says: “We probably think we’ve hit the bottom. We’re a bit ahead of the rest of the country and we’re finding there are a lot of people out there looking. We’re getting multiple offers on houses that we’ve not had for 18 months. Homes are selling faster,” she adds.

“It’s not shooting up at great rates but it’s steady,” says Nicki.

While buyer interest has been very focused on first home buyers in recent months, families buying their second home are playing a more active role, she adds. They’ve run out of room, and they want to buy a bigger property, she explains.

In Dunedin, meanwhile, Joe Nidd, owner of independent Dunedin brokerage Nidd Realty says the feeling there is that the bottom of falling prices has been reached.

And the stats back that up, says the agency principal. “We’ve had three months (February to April) now where the median sales price has been around $570,000,” he says. And open home numbers are up.

There’s strong activity from first home buyers and investor sentiment is changing, he notes. “There are more investors in the market which is a pretty good indicator that people are picking the bottom because, if they’re looking to buy now, they’re starting to see value even in a higher interest rate environment.”

The market is incredibly price sensitive, he warns. Buyers are intolerant of what they see as an inflated price. “People are just “watchlisting” homes on Trade Me Property and waiting until they see good value,” he says.

As for Christchurch, which hasn’t been as volatile a market as others in the country, Tall Poppy franchise owner, Debi Pratt says after some doom and gloom in January to March, inquiries are going up in her market and open home attendances are well up. About a month ago, her top sales person had six or seven listings which were attracting very little buyer activity. Then a month ago the whole lot went under contract, she says. These were homes in the $500,000 to $800,000 range, a mixture of first and second homes.

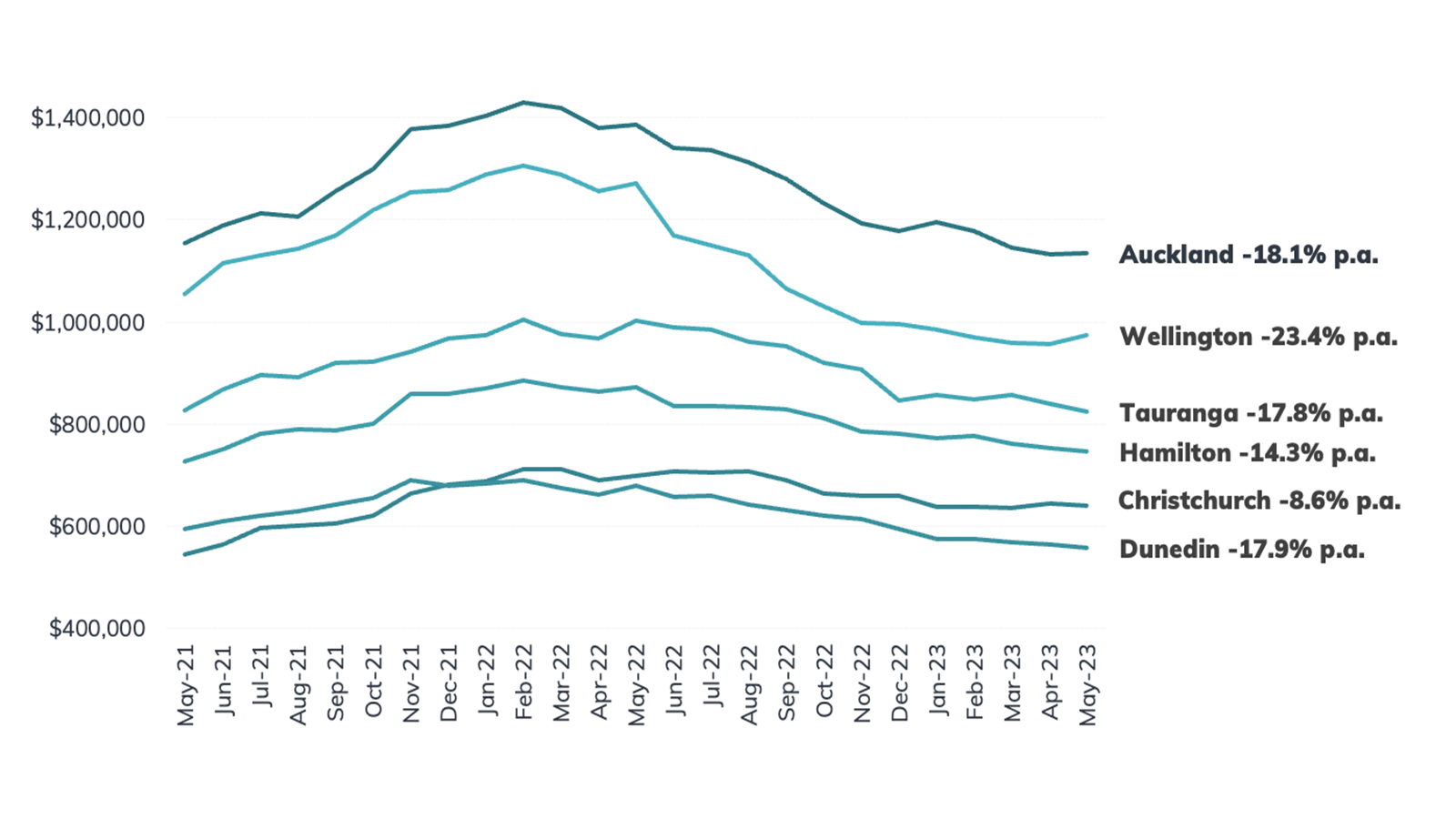

Median HomesEstimate: Trends in our Main Cities

Source: homes.co.nz Monthly Property Update - May 2023

Regional differences in markets hitting the bottom

Various markets around the country are reaching the bottom, while others are yet to get there, says Bayleys National Director of Residential Sales, Johnny Sinclair. Those who saw price falls first are coming out of it earlier than others, he explains.

“The Golden Triangle (Auckland, Tauranga and Hamilton) and Wellington have seen the bottom first,” he says. Next, he expects the Hawke’s Bay, Gisborne and Whanganui to find their base line.

And for these markets coming out of the doldrums there won’t be a big jump in numbers of listings, he expects supply to rise by around 10% –15%.

UP Real Estate director Barry Thom supports the Bayleys’ director’s reading of the Auckland market.

“In terms of inquiry and open home numbers, offers received and sales made in the last four weeks, the market is definitely showing an improvement,” he says.

When it comes to days on market, a beautiful, modernised home, with four bedrooms will sell in less than 30 days if it’s part of an auction programme.

“I don’t think we’re out of the woods yet but green shoots are sprouting,” says Barry.

A prettier picture for sellers

If you need some more stats, to help make your buyer or selling decision, Ray White New Zealand Chief Executive, Daniel Coulson has some. Looking at the company’s new listings over the 28 days to May 17, they’re down 21% on this time last year. At the same time, inventory is up overall by 19.04 percent from 12 months ago – so there’s more choice for buyers today though less new stock coming onto the market, he explains.

Meanwhile, property inspections are up 13% for the same period and, according to Loan Market data, pre-approvals are 18.10% higher than 12 months ago.

Another interesting piece of information, property appraisals are 19.2% below where they were this time last year over 28 days. So, as a seller, there’s less competition than the same time last year. “And when you combine that with higher inspection numbers and higher pre-approvals, it paints a pretty good picture if you’re coming in today as a seller,” says Daniel.

If buyers believe the market is going to remain flat for the next 6-12 months they may be better off purchasing today than in 12 months’ time when the market is going up,” advises the Ray White CEO.

Any change in market conditions is much quicker and more pronounced today than it was 10 years ago, he explains. It used to take six months for a market turnaround to take effect, now with the availability of information, it’s much quicker.

“I would suggest anyone sitting on the fence waiting for what might happen next, may find themselves in a different marketplace soon,” he says.

Buyers and sellers impatient to move on with their lives

People have put their lives on hold over the last 12 months and more despite changes in their lives necessitating a smaller or larger home, says Harcourts Managing Director, Bryan Thomson.

His message to buyers and sellers is that the majority of price falls have taken place, so it’s time to take action.

“Anecdotally, based on inquiry and open home attendance and success in auction, we’re close to a tipping point,” he says. And that’s not about going back to the post-Covid sugar rush but back more in line with more normal levels of transactions, he adds.

“I don’t think anyone is predicting significant price changes but we’re all expecting more volume,” says the Harcourts MD.

To sellers he says: “If you wait until everyone else decides to act, there will be competition. At the moment you’re more in isolation and, if you’re transacting to purchase, I wouldn't wait until spring,” he says.

Author