Feature article

Is it really harder to be a first home buyer right now?

We investigate the cost of living, interest rates, inflation and house prices.

6 March 2023

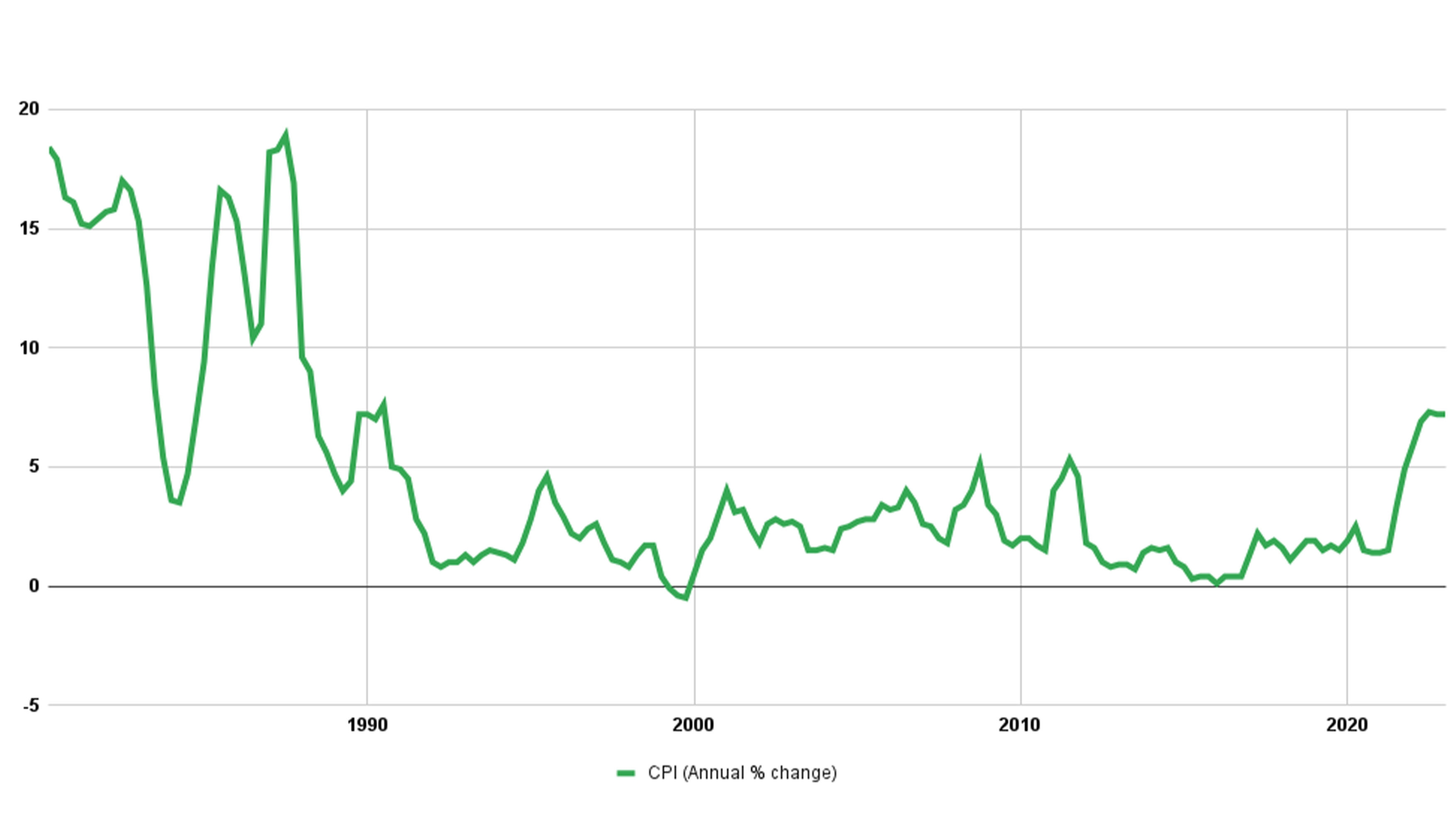

Economists, politicians and Kiwi are wringing their hands over the cost of living in 2023, with inflation at a reportedly 32 year high at 7.2%. Rents are at an all time high and the Official Cash Rate (OCR) has once again been increased, so for those saving to buy a home and more, it feels like they can’t catch a break, even with falling house prices and low unemployment. So how bad, or good, are current conditions compared with decades past?

What you’ll learn:

- Inflation today vs decades ago

- How much have prices increased?

- Finding the positives in today’s market

If you go back over the decades you’ll find conditions were, at times, equally challenging though with different variables. For instance, did you know that in the 1980s, the inflation rate was over 13% thanks to the monetary policy at the time and mortgage rates were over 20% for many. So the first few years of a mortgage were very hard work but houses were cheaper so things got easier after a while.

Consumer Price Index (CPI) (Annual % change)

Source: Stats NZ

Chart Summary: The Consumers Price Index (CPI) measures changes to the prices of the consumer items New Zealand households buy, and provides a measure of household inflation.

These double-figure inflation rates in the 1980s were matched by a similar growth in incomes, says Infometrics chief forecaster, Gareth Kiernan, author of the Housing Update 2022 report which looked at relevant data from the past 70 years.

While current wages aren’t increasing by double figures as they were in the 1980s, wages are strong at the moment, the highest percentages and the fastest growth in the past 30 years, says Gareth. There’s been a 7.4% increase in average hourly earnings for the year to December 2022 up from a 3.8% increase in 2021, according to Stats NZ. He's expecting to see above-average wage inflation for the next 12 to 18 months, at around 3.5% to 4%.

At the same time, current inflation is right across the economy, food, fuel, household utilities and services. The CPI inflation rate of 7.2% hasn’t been this high since 1990, says Gareth. Between 1973 and 1990, inflation was running at 13% to 14% per annum.

“We’re not at critical levels, just higher than it’s been for a generation,” says Gareth.

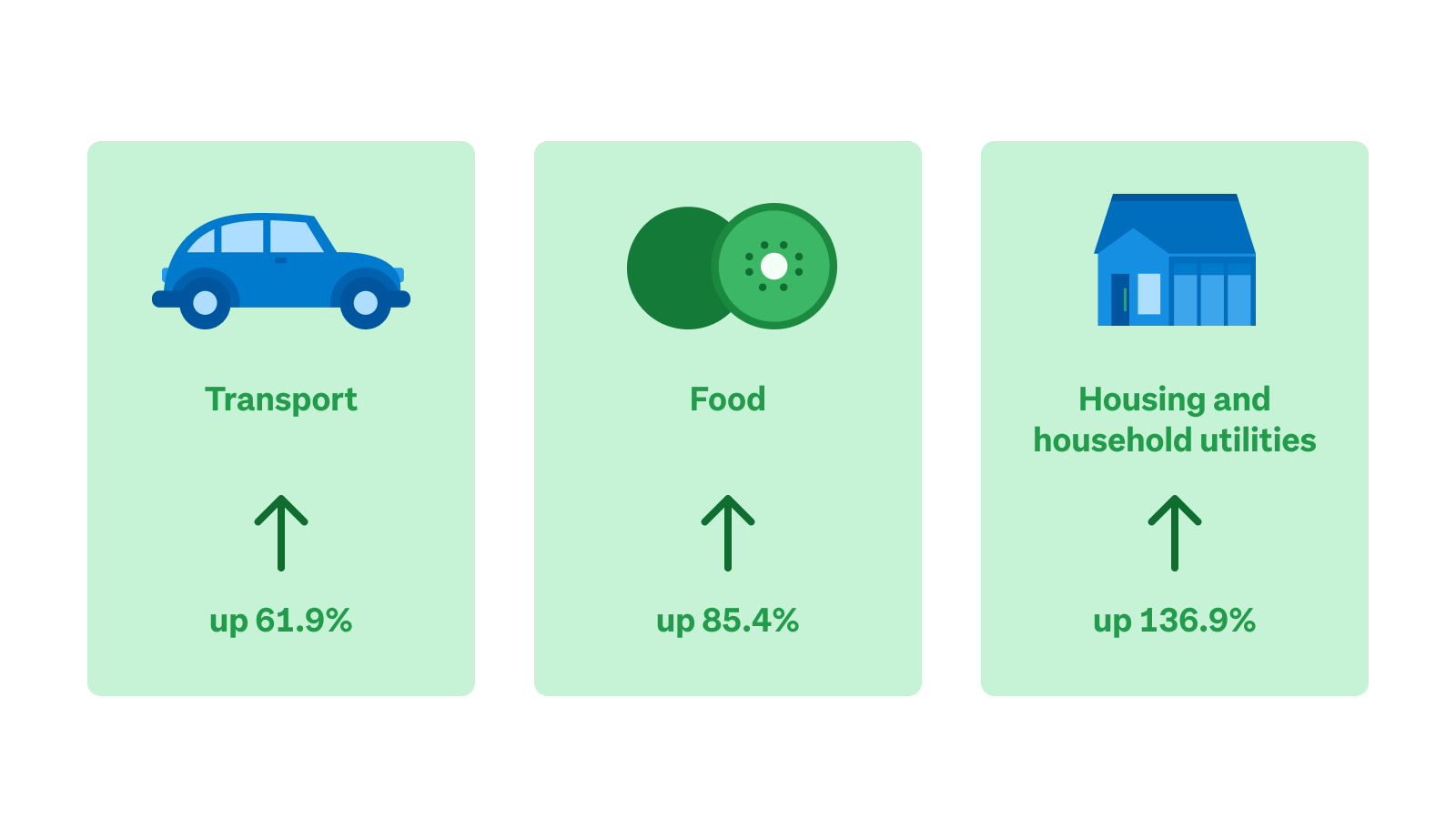

So, how much have prices increased?

In the last 23 years:

Figures from Stats NZ Consumer Price Index Outputs team.

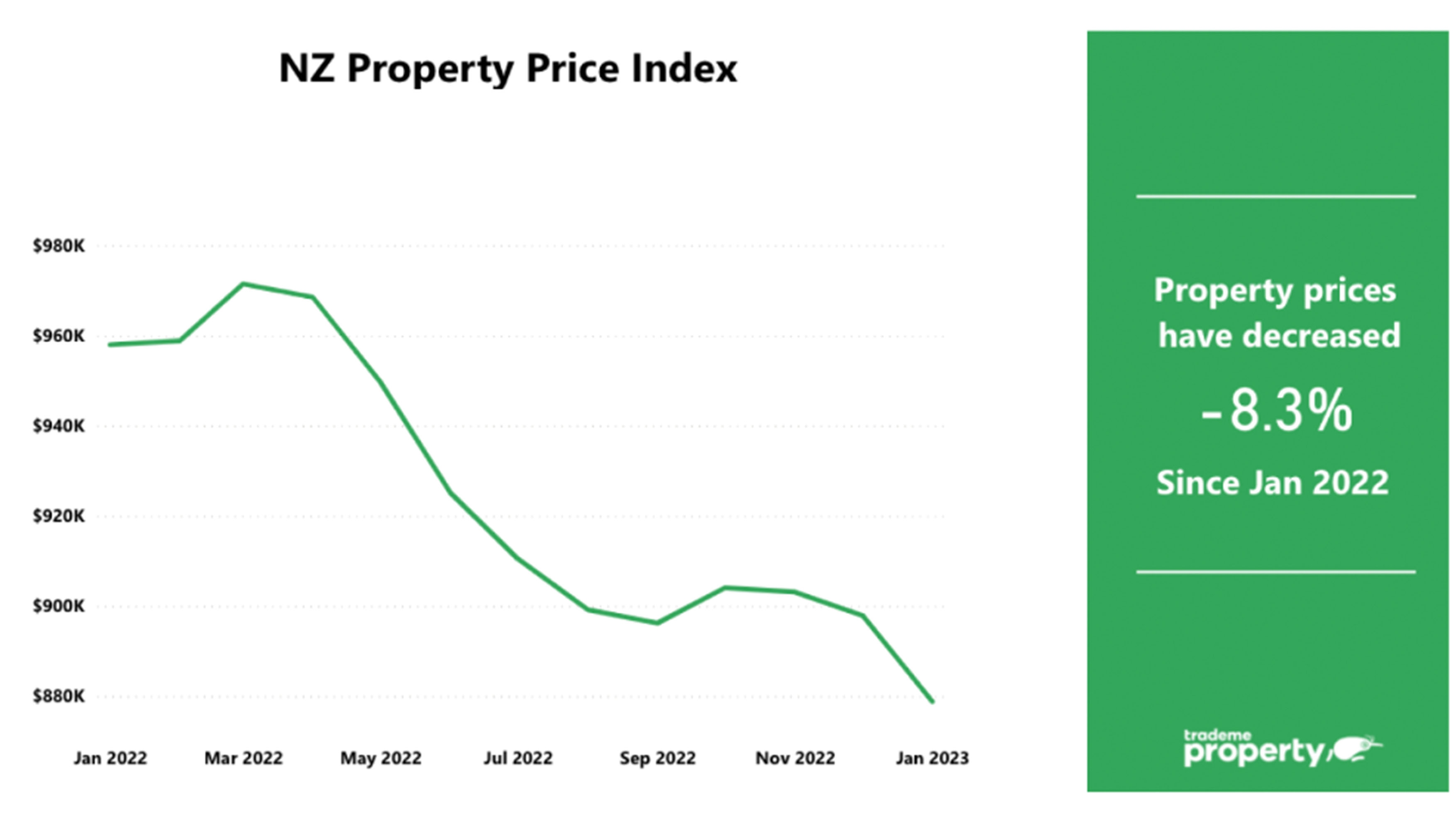

House inflation going in a different direction

While most consumer products are rising in price, Trade Me Property Price Index’s national average asking price for a home fell by 8% year-on-year in January 2023 to $879,800, the largest drop Trade Me has ever seen. In January 2022, by comparison, the national average asking price skyrocketed 25% year on year, says Trade Me Property Sales director Gavin Lloyd.

Another piece of good news for first home buyers feeling held back by the high cost of living is that affordable homes around the country, likely to appeal to first home buyers are those dropping in price the most, according to interest.co.nz’s Home Loan Affordabilty Report. Prices dropped substantially in most regions of the country in January, according to REINZ, for instance in the Bay of Plenty, the selling price of the most affordable homes declined by 13.9% from $692,000 in December to $596,000 in January 2023.

Housing is becoming more affordable as prices drop across the country.

But it’s not all good news. Sense Partners’ economist Shamubeel Eaqub says compared to the peak of the housing market things have gotten better on the deposit front but servicing the mortgage has become more expensive.

“The difference between now and the 1980s and 1990s is you could save a house deposit within 10 years of working and you could pay it off in 10 years if you were putting one third of your income into the mortgage,” he says.

Now it could take you decades to save the deposit if you’re on a normal salary, he says, with people spending up to 40% of their income on rent.

“The goal posts keep moving,” argues First Home Buyers’ Club director, Lesley Harris. First home buyers are renters, and on top of that they have the cost of living to contend with, Auckland rents currently over a third of people’s incomes, she says.

And those 20% deposits are hard to get to when you’re buying a million dollar house. “When I bought my first house in the 1990s I could get 10% lending, which is very hard now. There was a lot more 5% lending in the 1990s but interest rates were higher then,” says Lesley.

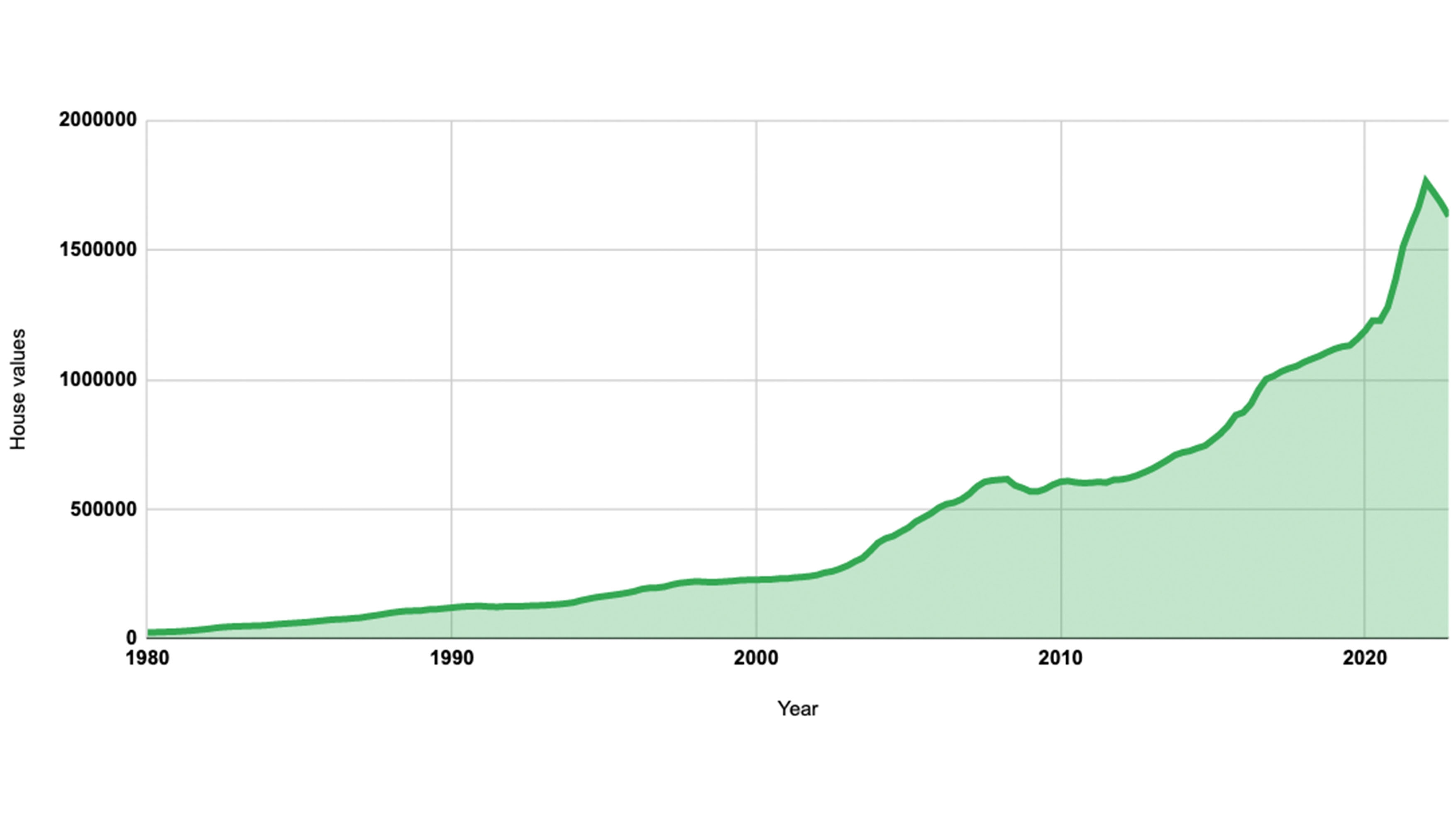

Wages may be rising but house prices have risen by more in recent years, she says. The average asking price in Auckland for a home is $1,116,850 according to Trade Me, compared with December 2017 figures of $941,850. Peoples wages haven’t gone up by that much, she says.

Value of housing stock over time

Source: CoreLogic. The data is compiled by CoreLogic and published by the Reserve Bank.

Easier to become a homeowner now than it used to be, says CoreLogic

CoreLogic chief property economist Kelvin Davidson believes it’s easier to buy a home now than in the 1980s because credit is more widely accessible now than it was in the 1970s and 1980s when you needed to show an established savings record.

“You couldn’t just go to a lender, you had to talk to the bank manager, there were no online applications going on,” says Kelvin.

For home buyers struggling with cost of living challenges, there’s more assistance for first home buyers, says Jarrod Kirkland, General Manager of Mortgage Lab.

“What’s changed from years ago is there’s assistance for first home buyers with partners like Kāinga Ora,” he says.

When it comes to cost of living, the difference between now and a few years ago - it’s harder to buy because you're paying more for the house but on the other hand it’s easier to get finance, he adds.

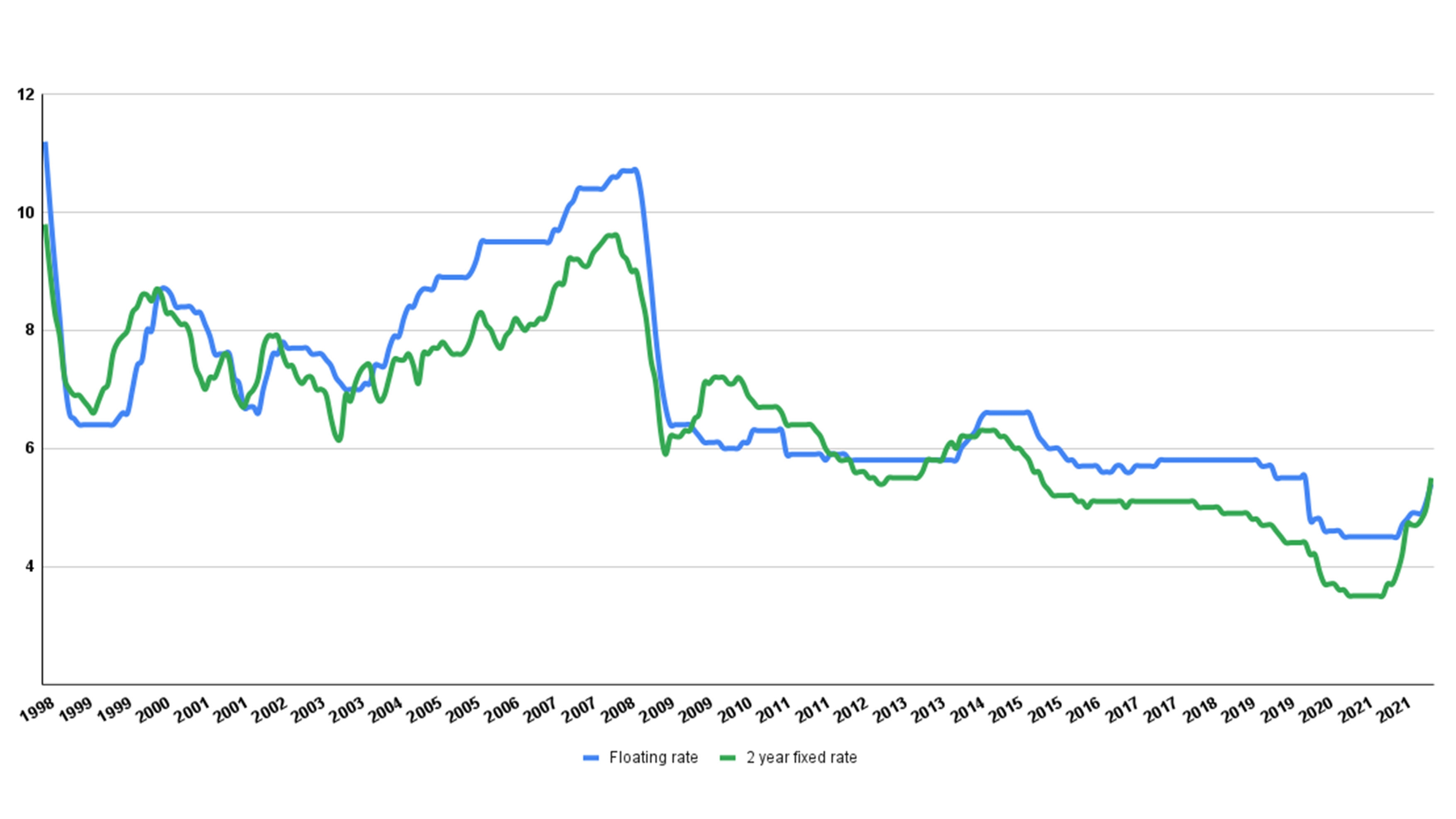

To homeowners dreading mortgage rates potentially increasing to 7%, seasoned mortgage adviser Geoff Bawden reminds Kiwi that not that long ago the average interest rate was 7%, and it was used as a barometer by mortgage advisers.

Banks Mortgage rates – Floating and 2 year fixed

Source: RBNZ

“A whole range of people think that a 3% mortgage rate is normal but it’s not sustainable,” he says. And it’s not that people weren’t tested to pay those higher rates but they’re just not accustomed to paying those rates.

Author